Overview, Statistics, Regulatory views and Research about how governments and businesses are exploring and adapting to blockchain and cryptocurrencies’ policies and regulation

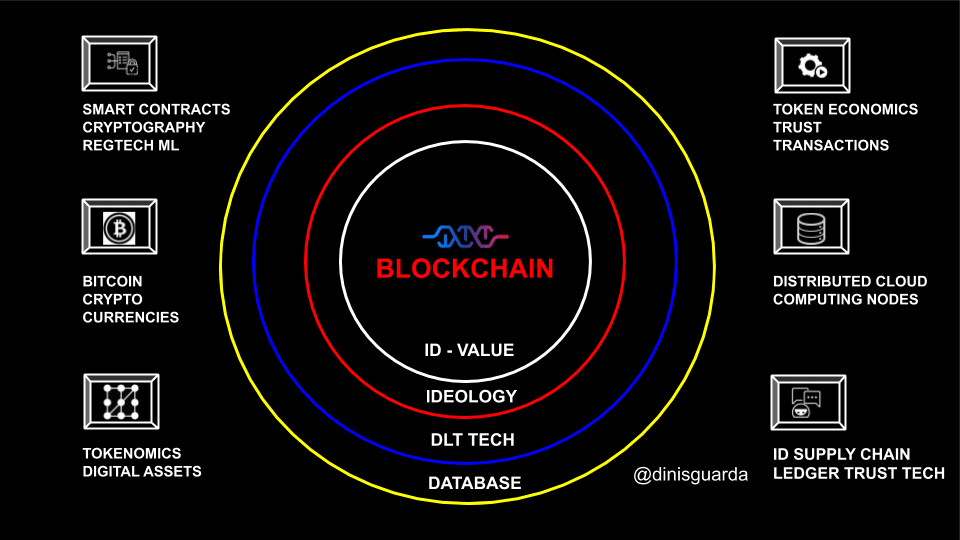

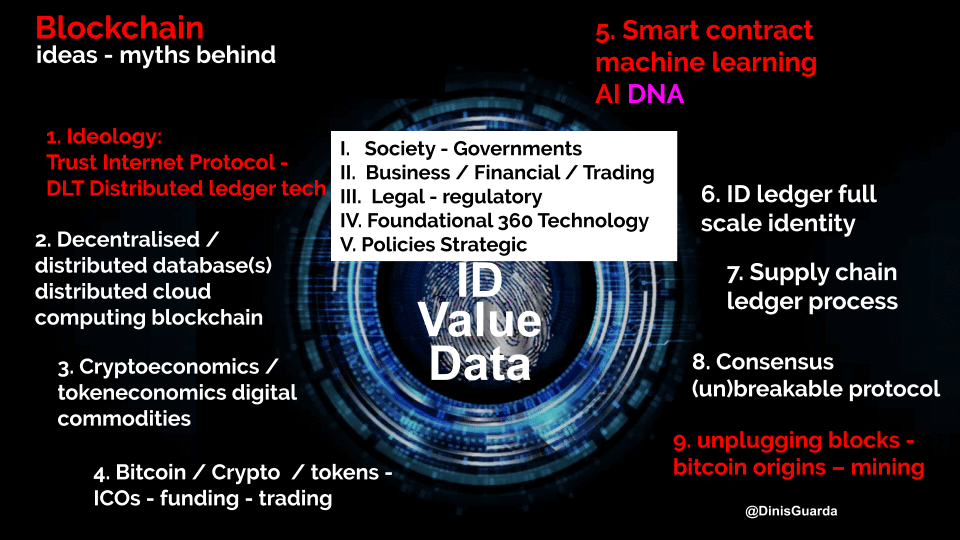

There have been big questions about what role of blockchain, cryptocurrencies, digital assets, tokens and tokenomics play in society. Cryptocurrencies and blockchain – the technology behind cryptocurrencies – have become a global phenomenon. Since the creation of Bitcoin, the world’s most well known cryptocurrency, the research on cryptocurrency and blockchain has become widespread and has generated an enormous amount of concerns among various countries’ governments, central banks and regulators. The most common concern is how to regulate cryptocurrencies. Because of its specific distributed and disintermediated nature, current rules cannot be applied to them. In this paper, we are going to go through some of the most prominent trends while assessing the complexity behind blockchain and cryptocurrency regulation.

Global economists such as Nouriel Roubini continue with his passionate assertion that 99% of cryptocurrencies are worth ZERO. He also states that it is fintech, and not blockchain, that will bring innovation to the banking system. Other major personalities such as the ex Governor of the Bank of England and heads of major investments banks have publicly attacked crypto currencies, but most of them have already initiated studies and deployment of the technology.

The president of the European Central Bank (ECB), Christine Lagarde, has said central banks and financial bodies should protect consumers but be open to innovations such as cryptocurrencies. Lagarde, who was previously the head of the International Monetary Fund, told the Economic and Monetary Affairs Committee of the European Parliament that central banks and financial regulators should embrace the opportunities presented by change.

Christine Lagarde via an IMF news release, said: ”In the case of new technologies – including digital currencies – that means being alert to risks in terms of financial stability, privacy or criminal activities, and ensuring appropriate regulation is in place to steer technology towards the public good. But it also means recognising the wider social benefits from innovation and allowing them space to develop.” Lagarde claimed that regulation of cryptocurrencies is “inevitable” and necessary on an international level. She also said that blockchain innovators are “shaking the traditional financial world” and having a clear impact on incumbent players.

Blockchain And Cryptocurrency Regulation: Case Studies

There is a fairly substantial amount of successful case studies in the use of cryptocurrencies for good.

In 2017, one of the influential officials of the Republic of Estonia made a suggestion about the implementation of a blockchain-based solution at the state level. This blockchain-based solution is the launch of crypto tokens that can be issued within their e-Residency program, a profound Estonian platform providing transnational government-issued digital identity service. The proposal went viral and provoked various reactions from both the public and private sector not only in Estonia but in other countries as well.

Cryptocurrencies are mainstream now. The USA IRS has made it mandatory to report bitcoin transactions of all kinds, no matter how small in value. Thus, every US taxpayer is required to keep a record of all buying, selling of, investing in, or using bitcoins to pay for goods or services (which the IRS considers bartering). Coinbase, the largest U.S. crypto exchange, appeased the IRS during their fight for obtaining taxpayer information, by issuing a Form 1099-K for larger accounts. Only U.S. exchanges might provide 1099-Ks. Coinbase also provided capital gain and loss reports for later years.

The Singaporean government’s taxation agency is proposing to remove goods and services tax (GST) from cryptocurrency transactions that function or are aimed to function as a medium of exchange.

Also in Singapore, one of the most advanced countries in blockchain and cryptocurrency regulation, the Inland Revenue Authority of Singapore (IRAS) recently published an e-Tax draft guide for treatment on what it calls the “Digital Payment Tokens,” seeking to exempt any entity dealing with such digital assets from GST liabilities. If the draft guide passes into legislation, the following changes will take effect to “better reflect the characteristics of digital payment tokens:

(i) The use of digital payment tokens as payment for goods or services will not give rise to a supply of those tokens

(ii) The exchange of digital payment tokens for fiat currency or other digital payment tokens will be exempt from GST.

The IRAS said the e-Tax guide is still in its draft form and that the Ministry of Finance will be holding a public consultation from now until July 26 on the “legislative amendments for digital payment tokens.” The draft guide also sets out detailed parameters on how digital payment tokens are defined, which should have all of the listed characteristics below:

- a) It is expressed as a unit

- b) It is fungible

- c) It is not denominated in any currency, and is not pegged by its issuer to any currency

- d) It can be transferred, stored or traded electronically

- e) It is, or is intended to be, a medium of exchange accepted by the public, or a section of the public, without any substantial restrictions on its use as consideration.

“Examples of digital payment tokens are Bitcoin, Ethereum, Litecoin, Dash, Monero, Ripple and Zcash,” the IRAS added in the proposal.

Notably, the Singaporean authority specified that stablecoins, a type of cryptocurrency designed to have a value pegged to a fiat currency, may not qualify to be GST exempt. “Any digital token that is denominated in any fiat currency or with a value pegged to any fiat currency will not qualify as a digital payment token,” the IRAS said in the draft. “For example, a digital token pegged to US dollars will not qualify as a digital payment token.”

IRAS said the effort to end GST liabilities on cryptocurrencies follows worldwide development and growth in the space that has led various jurisdiction to have reviewed their stance. “Similarly, IRAS has reviewed its GST position to keep up to date with these developments,” the agency said. Under the current framework, the supply of digital payment tokens is still seen as a taxable supply of services. “Therefore, the sale, issue or transfer of such tokens for consideration by a GST-registered business is subject to GST. When the tokens are used as payment for the purchase of goods or services, a barter trade resulting in two separate supplies arises — a taxable supply of the tokens and a supply of the goods or services,” the IRAS said in the draft.

In October 2017, lawmakers in Australia passed a piece of legislation to end what was called double taxation, exempting the liability for paying goods and services tax (GST) on cryptocurrency purchases.

Regarding trading and investing using crypto currencies, the case of Fidelity would be a representative example. Fidelity is one of the largest mutual fund managers that has launched its crypto trading desks. Another example is the Bill and Melinda Gates Foundation partnership with Ripple’s Interledger for mobile payments.

Many economists and digital innovators are still divided on the role that cryptocurrencies and blockchain might play in the financial system. This is increasingly changing, especially fostered by projects from central banks – like China and its proposal to create a Central Bank Digital Currency, and non-financial big enterprises’ projects, like Facebook and its stablecoin-like Libra cryptocurrency.

Some notes to help us better understand the role of cryptocurrencies in the present and their future in society

I am an academic, researcher and entrepreneur whose main expertise is in the financial industry, macro economics and someone that specializes in fintech, digital transformation, AI, and blockchain technologies as both a researcher and practitioner.

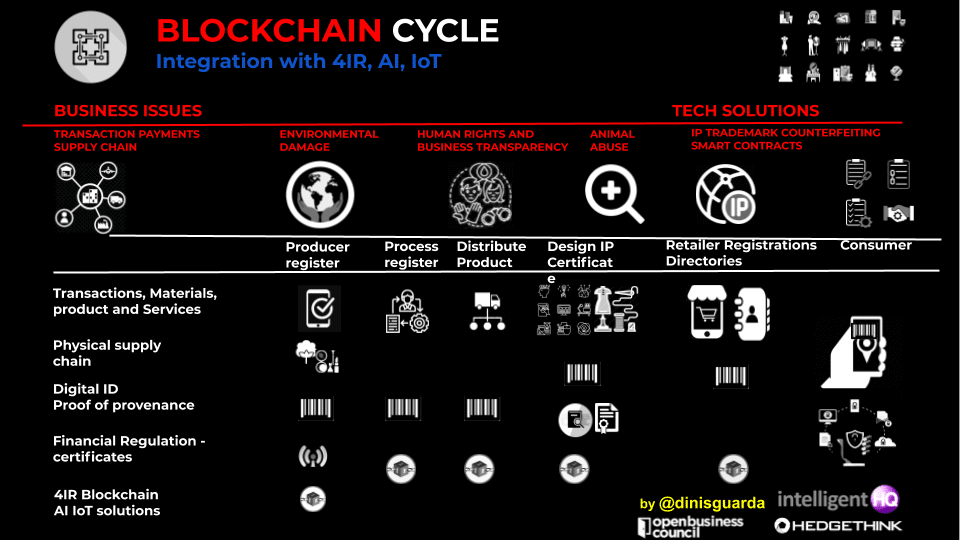

We are on the verge of a complex new economic and financial world driven by digital systems and where innovations are increasingly disruptive. This is a very important introduction to help us understand how the networked world we live in works and how it can help us innovate and move from centralized systems to distributed, partly decentralised, technology and financial systems. Also how digital money is taking the place of crypto currencies and digital assets.

In the last 5 years blockchain driven technologies have helped to scale, and shape the economic, financial and supply chain world and they are now present in anything that deals with financing, payments and digitising money, transactions and creating increased transparency in the financial and business world. They are part of the metrics that can help achieve the UN’s Sustainable Development Goals (SDGs) by 2030.

So why are Blockchain Cryptocurrencies valuable to society? If so, what are the main areas cryptocurrencies will do for society in the future?

Cryptocurrencies are very valuable to the global economy, and to society in general. Money plays a critical role in the evolution of society. As we digitize the money and the financial systems we need, more better and more appropriate financial technology and solutions are needed to help with this. Cryptocurrencies are one of the most innovative tools developed in the last decade. Although they are not simple nor conventional, they effectively offer multiple solutions with ways to improve society and financial, business, government and economic models.

What are the benefits of cryptocurrencies and blockchain?

1. ID & Data Self-sovereignty

2. Smart contract Certification

3. Digital ID Trust

4. Smart contract open API Collaboration

5. Reward gamification

6. Compliance for accreditation

7. Payment and fees

8. Profile track record

9. Personal development tracking technology

10. Government and institutions ID smart contract solutions

11. User Autonomy

12. Discretion and security

13. Peer-to-Peer Focus and solutions

14. Elimination of Banking Fees.

15. Very Low Transaction Fees for International Payments.

16. Mobile Payments.

17. Accessibility.

In order to understand the role cryptocurrencies can play in our future society, let’s look at what money does. Money provides four basic functions; it serves as a store of value, an exchange of value, a means of payments and a common measure of value.

Historically, the continuing invention of money opened the doors to increased trade (effectively overcoming the challenge of “double coincidence of wants’) enabling financial and economic growth around the world. But the world was not digitally transformed like now and money was invented without digital assets. With the mainstream effects of the internet in society and financial markets and all that it has enabled, we are witnessing a steady transition away from value embedded in physical assets to value created by digital assets. An example, are the world’s top leading companies that are all technology companies, with digital assets and data as a primary asset. This created a fundamental rethinking of the meaning and functionality for value and money. While digital money is not new at this point, the underlying mechanism – where the money is pegged to physical assets – hasn’t changed since the collapse of Bretton Woods and the advent of the petrodollar in 1974.

With the invention and growth of bitcoin – as the world’s first cryptocurrency – and the current wave of decentralization, a fundamental rethinking of value has been rather overdue.

As it can be seen digital assets and in the first case study Cryptocurrencies when well used serve as a stable store of value in a world where the value of fiat money is directly dependent on the actions of national governments, both in the domestic economy as well as in the international currency markets. They can be particularly useful for countries with a weak national currency or excess inflation. Since cryptocurrencies are based on a distributed global ledger, no one country or national government has control over its price (say, bitcoin or ethereum). Following this assumption a cryptocurrency is, essentially the tokenization of assets, as opposed to petroleum assets and it is becoming a reference of storage for all the things that are useful in society.

So as we look at “data as the new oil”, then from a monetary economics point of view, there is no doubt that it makes sense to have a common global currency which can serve as the reserve currency of the world, effectively acting as a substitute for competing national currencies. This is not simple but with a distributed global network, the price of the cryptocurrencies is determined by market demand and supply. This can be done by organisations, central banks of governments.

The technology adoption lifecycle can serve as a useful framework to understand the adoption of any new product or innovation, including cryptocurrencies and the underlying technology, blockchain.

For cryptocurrencies to become an effective viable reserve money / currency, lots needs to be done. The first and the foremost thing that needs to happen is for a viable process of understanding digitised assets and its value. And this requires alignment of geo politics and financial strategies. Also it requires price discovery in the currency markets and subsequent stability in price.

Regulation can and is necessary as a proper way to create mass adoption of cryptocurrencies as well, depending on how different governments choose to regulate the technology as well as how different market players interact with the technology. It is the complex interplay of these factors that would dictate whether or not we witness mass adoption of cryptocurrencies. Cryptocurrencies are part of our economic, financial and business world and are here to stay and the fact that greater regulation is good news for the crypto space. With more regulation comes greater protection for retail investors (but, in fact, all players in the market) which, in turn, drives greater adoption.

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.