14 Giga projects, including the well-known Neom, are shaping Saudi Arabia in alignment with the 2030 vision of Crown Prince Mohammad bin Salman. While most of the projects are directly funded by the country’s sovereign wealth fund, the Public Investment Fund, some of them like the Mohammed bin Salman Non-profit City, are funded by the crown prince himself.

The primary objective of the Giga Projects is to facilitate a significant transformation of the Saudi Arabian economy, while also serving as a showcase of the nation’s geographical richness, cultural heritage, hospitality, economic goals, and commitment to environmental conservation.

These endeavors assume heightened importance at present, playing a crucial role in attracting foreign investments and fostering increased economic expenditure. The Kingdom has set ambitious expectations, anticipating a substantial influx of $7 trillion in investments and government spending to materialise within the concluding decade.

“We in the kingdom are currently undergoing a historic transformation under our Saudi Vision 2030 that aims to foster a vibrant society, a thriving economy and an ambitious nation. The kingdom will work with the G20 members to exchange experiences, solidify global co-operation and find solutions for the world’s most pressing challenges of the 21st century.” – Former King and Prime Minister of Saudi Arabia, Salman bin Abdulaziz Al Saud.

The Giga projects range from singular, massive sites like Masar in Makkah (Mecca), the Jeddah Central Project, and King Salman Park in Riyadh to more widespread endeavors. Saudi Downtown Company is spearheading initiatives to establish downtowns in 12 cities, while Roshn, a property developer, seeks to construct 400,000 homes across Saudi.

Featuring designs by renowned western architects such as Zaha Hadid Architects, Ricardo Bofill, Heatherwick Studio, BIG, Foster + Partners, Jean Nouvel, LAVA, Morphogenis, Adjaye Associates, Henning Larsen, and SOM, these visionary projects serve as ambitious landmarks.

Here are some of the iconic projects:

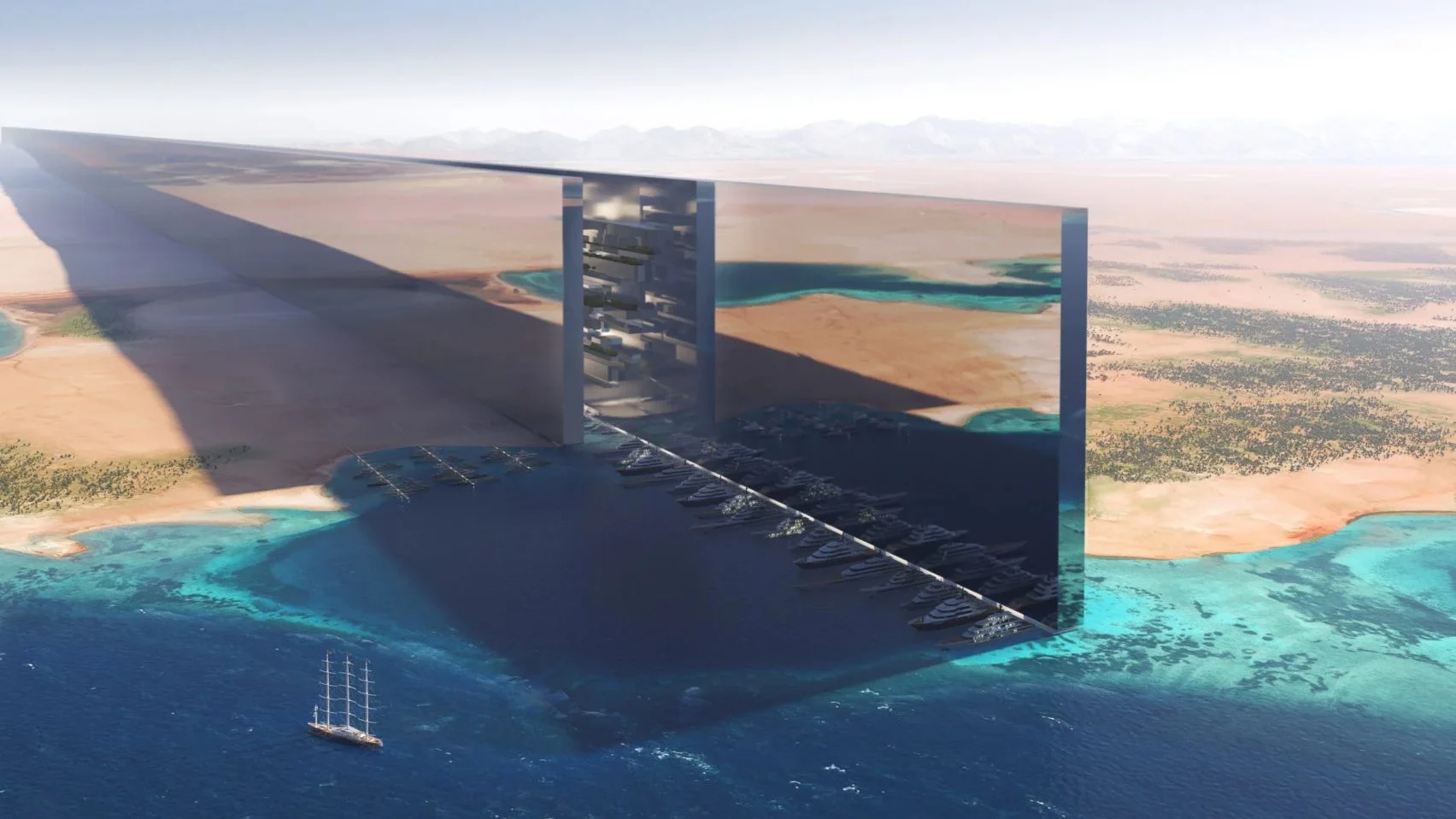

Neom

Neom, undoubtedly the most renowned among Saudi Arabia’s giga projects, stands as the largest and most controversial scheme in development within the kingdom. Encompassing a vast expanse of approximately 10,200 square miles, Neom is designed to comprise 10 regions, with four already disclosed. Notable among these regions is “The Line,” a 170-kilometre-long city. The other announced areas include Oxagon, an octagon-shaped port city, Trojena, a ski resort, and Sindalah, an island resort.

Roshn: Elevating Homeownership and Urban Living

Roshn is an equally ambitious project, striving to increase Saudi Arabia’s home ownership rate to 70% by 2030. This initiative, spearheaded by the Public Investment Fund, has set the ambitious goal of constructing 400,000 homes.

The Red Sea Project – A Tourism Oasis

The Red Sea Project, another spotlight initiative owned by the Public Investment Fund, focuses on developing coastal areas into resorts to bolster the country’s tourism sector. This endeavor comprises two key developments: The Red Sea and Amaala.

Diriyah – A Cultural Transformation

The Diriyah development, covering seven square kilometers in the west of Riyadh, centers around the UNESCO World Heritage Site of At-Turaif, regarded as the birthplace of the Al Saud family.

King Salman Park – World’s Largest Urban Park

Under construction in central Riyadh, the King Salman Park project aspires to be the world’s largest urban park. Master planned by Danish studio Henning Larsen and Saudi studio Omrania, the 16.7-square-kilometer park will boast 11 square kilometers of green space, one million trees, and landmark buildings like the Royal Arts Complex designed by Ricardo Bofill and a visitor pavilion by Adjaye Associates.

Jeddah Central – A Residential Landmark

Jeddah Central – A Residential Landmark

Covering 5.7 million square meters, the Jeddah Central development, financed by the Public Investment Fund, is predominantly residential, with 17,000 residential units and 2,700 hotel rooms.

The project’s landmarks include an arts center designed by Heatherwick Studio, a stadium by GMP Architecten, an opera house by Henning Larsen, and an oceanarium by SOM.

Qiddiya Project – The Capital for Entertainment and Culture

Qiddiya Project – The Capital for Entertainment and Culture

Described as “Saudi Arabia’s emerging capital for entertainment, sports, and culture“, the Qiddiya Project is taking shape to the west of Riyadh. Encompassing 367 square kilometers, it will house diverse entertainment facilities, including sports arenas, concert halls, a racetrack, a Jack Nicklaus-branded golf course, and a Six Flags amusement park featuring the world’s longest, tallest, and fastest rollercoaster.

The entire project is 100% owned by the Public Investment Fund.

Murabba – A Commercial and Entertainment District

Murabba – A Commercial and Entertainment District

Murabba, designed to redefine Riyadh’s skyline, centers around a 400-meter-high cube-shaped skyscraper named Mukaab. This commercial and entertainment district spans 19 square kilometers, featuring a variety of amenities within the cube, such as shops, cultural attractions, and tourist destinations.

Led by Saudi Crown Prince Mohamed Bin Salman, the broader Murabba project encompasses 100,000 residential units, 9,000 hotel rooms, and extensive office and retail spaces.

Saudi Downtown – Transforming Cityscapes

Saudi Downtown – Transforming Cityscapes

Owned by the Public Investment Fund, the Saudi Downtown Company is on a mission to create modern, mixed-use downtowns in 12 Saudi Arabian cities. Stretching across 10 million square meters, these developments aim to foster diverse local cultures and create vibrant urban destinations.

Masar – Redevelopment Alongside the Grand Mosque

Masar – Redevelopment Alongside the Grand Mosque

Umm Al Qura for Development & Construction leads the Masar project, a redevelopment initiative spanning a 3.6-kilometer-long stretch of land alongside the Grand Mosque in Makkah. Featuring 205 towers and centered around a 60-meter-wide pedestrianized street leading to a mosque, the project, involving Saudi studio Omrania, US studio HOK, and UK practice RMJM, is expected to be completed by 2035.

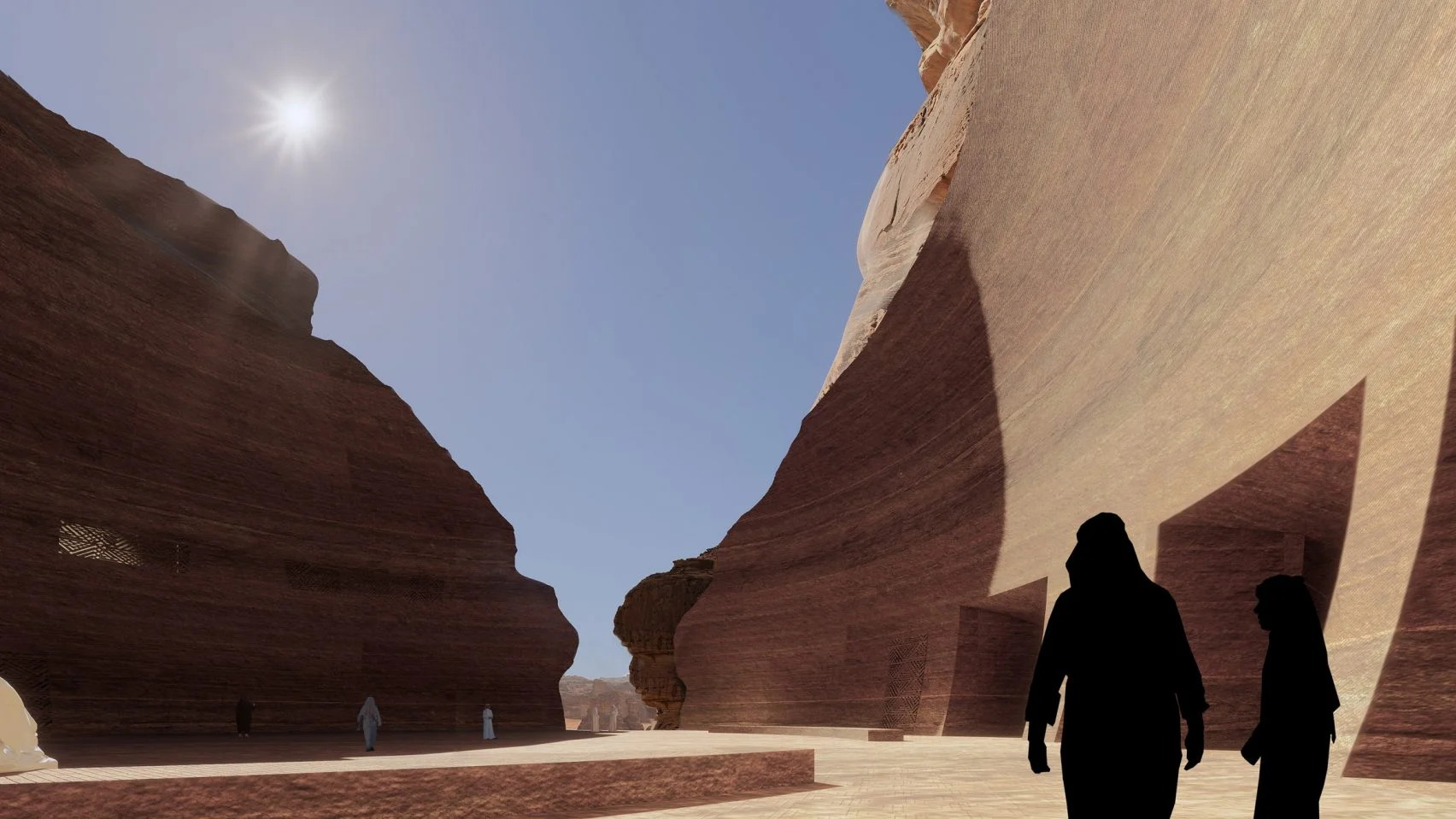

Al’Ula – Cultural and Touristic Ambitions

Al’Ula – Cultural and Touristic Ambitions

Located in the northwest of the country, Al’Ula is pivotal to Saudi Arabia’s cultural and touristic ambitions. This UNESCO World Heritage Site development includes the construction of museums and hotels, featuring innovative designs such as the subterranean hotel by Jean Nouvel and a luxury tent resort by AW2, among other notable projects by renowned architects.

King Abdullah Financial District (KAFD) – A Financial Hub

King Abdullah Financial District (KAFD) – A Financial Hub

Although not technically a giga project, the King Abdullah Financial District in Riyadh is a colossal office and residential district largely completed. Encompassing 1,600,000 square meters, it hosts 61 towers and skyscrapers designed by prominent studios like Omrania, SOM, Gensler, HOK, CallisonRTKL, and Foster + Partners. Connected by air-conditioned bridges and a monorail system, the district plays a crucial role in Riyadh’s urban landscape.

Mohammed bin Salman Non-profit City (MISK) – Fostering Future Leaders

Mohammed bin Salman Non-profit City (MISK) – Fostering Future Leaders

Named after Crown Prince Mohammed bin Salman and funded by his personal foundation, MISK is designed as a 15-minute city with automated buses. Arranged around a central spine covered by a giant shaded system by CallisonRTKL, the project includes a transparent art institute by Studio Anne Holtrop, a headquarters for the MISK foundation by Conrad Gargett, and the Center for Science, Technology, Reading, Engineering, Arts, and Mathematics.

Seven – Entertainment Districts for Tomorrow

Seven – Entertainment Districts for Tomorrow

Entirely owned by the Public Investment Fund, Seven focuses on making tomorrow more entertaining. With 10 entertainment districts planned across the country, including projects in Riyadh, Almadinah, Tabuk, and Yanbu, Seven caters to the youthful population with diverse offerings like indoor arenas, arcades, bowling, indoor golf, climbing, indoor surfing, skydiving centers, and cinemas.

How do Giga Projects affect Saudi Arabia’s economy?

How do Giga Projects affect Saudi Arabia’s economy?

Vision 2030, launched in 2016, aimed to steer Saudi Arabia away from oil dependency, and significant progress has been achieved. The workforce participation rate for women exceeded the target, reaching 37% by 2022, contributing to the development of the domestic labor force.

The private sector witnessed a historic high of 2.2 million Saudi workers, marking a shift in perceptions, with more than 90% of unemployed citizens expressing willingness to accept private sector jobs. This change, coupled with a substantial drop in the unemployment rate from 15.4% in early 2020 to 8% at the end of 2022, has showcased the success of economic diversification efforts.

The robust GDP growth of 8.7% in 2022, reaching over $1 trillion, positioned Saudi Arabia as the world’s 17th-largest economy. While oil activities expanded significantly, non-oil sectors, including the private sector, also contributed to this growth. The private sector’s contribution to GDP stood at 43%, slightly below the target of 65% set for November 2022, indicating room for further improvement.

In terms of trade, investments in domestic refining and economic diversification efforts led to a reduction in trade as a share of GDP. Oil exports surged, accounting for almost 80% of outbound shipments, while non-oil exports also saw substantial growth. The balance of trade reached a surplus of $221.6 billion by the end of the year.

Despite the challenging global energy prices, Saudi Arabia resisted inflation, maintaining a stable inflation rate of 2.5% in 2022. Fiscal policies, including strategic reserves and subsidies to Aramco, contributed to this stability. The Saudi Arabian Monetary Authority (SAMA) implemented interest rate hikes to ease pressure on the Saudi riyal, maintaining its peg with the US dollar.

Fiscally, Saudi Arabia recorded a budget surplus in 2022, the first in almost a decade, driven by higher oil prices and effective fiscal consolidation measures. Revenue from oil and non-oil sources exhibited positive trends, with non-oil revenue rising in the fourth quarter.

Saudi Arabia’s dedication to achieving Vision 2030 is evident in ongoing and upcoming Giga Projects. NEOM awarded contracts for a high-speed railway, and Red Sea Global venues are set to open. The new King Salman International Airport and the Special Integrated Logistics Zone (SILZ) in Riyadh reflect efforts to establish the Kingdom as a regional logistics center.

The focus on SMEs remains a key element of Vision 2030, targeting a growth contribution of 35% to GDP. The SME Bank, established in 2021, and initiatives like the Taleed Program by Aramco aim to support SMEs. Regulatory improvements, such as the new Companies Law, prioritize SMEs in government tenders and procurement.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist, he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.

Jeddah Central – A Residential Landmark

Jeddah Central – A Residential Landmark Murabba – A Commercial and Entertainment District

Murabba – A Commercial and Entertainment District Saudi Downtown – Transforming Cityscapes

Saudi Downtown – Transforming Cityscapes Masar – Redevelopment Alongside the Grand Mosque

Masar – Redevelopment Alongside the Grand Mosque Al’Ula – Cultural and Touristic Ambitions

Al’Ula – Cultural and Touristic Ambitions King Abdullah Financial District (KAFD) – A Financial Hub

King Abdullah Financial District (KAFD) – A Financial Hub Mohammed bin Salman Non-profit City (MISK) – Fostering Future Leaders

Mohammed bin Salman Non-profit City (MISK) – Fostering Future Leaders Seven – Entertainment Districts for Tomorrow

Seven – Entertainment Districts for Tomorrow How do Giga Projects affect Saudi Arabia’s economy?

How do Giga Projects affect Saudi Arabia’s economy?