Staying in Tune with The Times – How Fintech Dictates Modern eCommerce

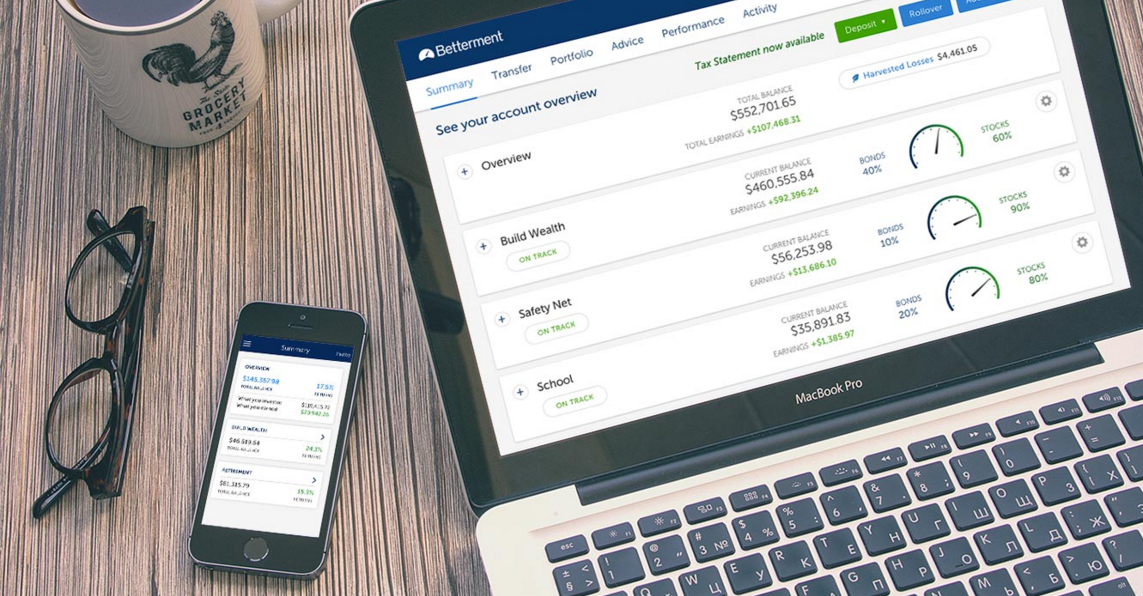

How Fintech Dictates Modern eCommerce ? The modern way of doing business goes hand in hand with technology, digitization, and mobility. Roughly half of the total online purchases and services today are made and ordered through smartphones, which emphasizes a strict need to conform to the mobile market and provide the most convenient mobile servicing conditions possible. Fintech comes in as the advanced niche that streamlines the implementation and use of all sorts of financial services (banking, insurance, trading, etc.) via up-to-date means and devices.

How Fintech Dictates Modern eCommerce

In particular, a high-performance fintech mobile app can help you leverage the way you provide services and make your customers’ lives much easier. In the long run, this translates into better customer loyalty, higher conversion rates, and more sales. This is why you may just want to stay in tune with the latest fintech trends and implementations to push your own financial services business.

How Fintech Dictates Modern eCommerce

Top Fintech App Development Trends in 2022

Making banking mobile-first

Mobile devices are increasingly preferred to conduct routine financial transactions. Specifically, about 77% of polled users have confessed to preferring to pay in this manner. “Why so?” – you may ask. Because a smartphone or tablet is constantly at hand, and modern digital technologies make almost all bank services available through such devices.

Mobile banking also assists financial organizations on top of providing a better consumer experience. In the long run, by providing accessible mobile banking opportunities, you get the following set of benefits:

- Minimized transaction expenses;

- Extended customer reach;

- Boosted availability of products and services;

- Boosted customer loyalty;

- Opportunities for the implementation of complex marketing strategies.

Keeping financial management smart

Artificial intelligence (AI) and machine learning (ML) are two of the most popular financial industry topics nowadays. From fairly simple chatbots to sophisticated network security solutions, you can make your fintech solutions smarter in a variety of ways. AI-based voice assistants never cease to be hugely popular, granting a personalized experience to each customer in their own finance application cabinet.

On top of all that, AI can be beneficially implemented in modern biometric authentication methods – e.g., for precise face and speech recognition or even recognition of written documents. Lastly, artificial intelligence enables a new level of user experience personalization by predicting user behavior – your fintech app can collect data on all user actions (so-called micro-interactions) and highlight the most frequently used features, tailoring the entire interface to a specific user’s preferences.

Reinforcing cybersecurity

Everyday business operations of any financial institution are always susceptible to security risks, including unauthorized access attempts, hacker breaches, and whatnot. What can a fintech business owner do to prevent the negative consequences of breaches? This is where cybersecurity solutions come into play.

Cybersecurity measures are aimed to protect an organization from unauthorized use of electronic data. These measures can include:

- Encryption. Encrypted data will be impossible for hackers to read, even if stolen.

- Access management. Authorized access on a need-to-know basis is crucial to prevent the leakage of the company’s sensitive information. Access and identity management are provided by this group of tools.

- Firewalls. These measures aim to protect against untrusted networks and potential malicious attacks by managing the outgoing and incoming network traffic.

- Anti-virus and anti-malware solutions. These fundamental cybersecurity solutions scan the system for threats and block viruses if detected.

Blockchain comes in as the underlying technology that helps achieve a sturdy level of protection with the help of smart contracts and transactions protected from any third-party intervention.

Bottom Line

Today’s mobile financial services consumer requires clear, understandable things – convenient mobile banking, smart automated operations, and sturdy protection from digital financial risks. Numerous ways to deliver all of that can be elaborated, but one thing is for sure – you need reliable, experienced specialists to help you achieve the highest quality here. Contact NIX United – your trusty custom mobile application company with years of field experience and practice in the fintech niche under our belt to deliver a top-of-the-line solution for you.

Related suggested article:How Is Fintech Changing The World We Live In?

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems