Growing popularity of forex trading

Due to the growing interest in forex trading in recent years, it is no wonder that there is an increasing demand for forex trading platforms as well. This is because people are now actively looking for credible platforms to conduct their activities on. In light of this, it is widely believed that the forex trading app industry is becoming quite lucrative and competitive, therefore, those who want to gain a significant market share need to have a competitive advantage, unique selling point and stand out from all the other platforms on the market. In the advent of technology and the digital era, those that fail to keep up with how people are now conducting daily activities, particularly when it comes to making money online or investing online, will surely fall behind.

Starting your own trading platform

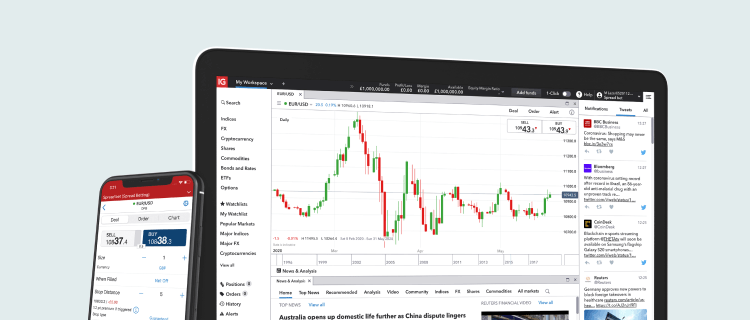

While the thought of starting your own forex trading platform can be quite daunting at first, it can also be quite an exciting endeavour. Moreover, it can also be quite lucrative and may be a promising business and investment venture. Contrary to popular belief, forex trading platforms offer more than just the option to trade forex, as they have additional resources and tools that may be useful to both novice and experienced traders. Therefore, you should also make a point of incorporating such into your platform to increase its chances of succeeding on the market. Further, because there are different regulations for forex trading in different countries, forex brokers open for USA trading are generally more likely to attract an audience because the USD forms part of the majority of forex trading activity. Below is a suggested guide and steps to follow if you are looking to build your own forex trading platform.

- Define your target market

A great starting point for any business venture is knowing who you are creating your product or service for. Similarly, when starting a forex trading platform, you need to know where your target audience resides so that you choose the best jurisdiction to register your platform, as previously alluded to.

- Accumulate sufficient capital

The cost of setting up such a platform is said to be quite high, therefore, it is recommended that you establish all the elements that you will need to pay for in advance. Moreover, you need to have excess funds for unexpected expenses, as well as have enough to cover a few months of operating costs, just to be on the safe side.

- Build a relationship with a liquidity provider

This will allow you to offer your clients leverage; partnering up with a credible liquidity provider is an integral part of a forex trading platform.

- Incorporate a payment processor partner

This aspect needs to be with a reliable partner that hopefully has a good track record and will not commit any scams or fraud. A payment processor partner will allow you to have different deposit and withdrawal options, which will ultimately provide convenience to your clients.

- Set up operations

This stage has many elements, such as website design, the additional services you wants to integrate, as well as all the other backend technicalities that need to be considered. If you have limited knowledge on this, you may want to consult a developer for further guidance.

- Pre-launch and launch phases

You are now ready to test and launch your platform. This will also allow you to identify and address any concerns or malfunctions, which is a continuous process post-launch. That being said, the platform will also require consistent maintenance.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems