Despite a significant amount of scams in the crypto industry, the hype around ICOs doesn’t die down. This procedure is still not regulated in most countries, so it’s possible to launch a project without a minimum viable product, raise the funds and then disappear with no legal consequences. The ICO scam list analysis reveals the most widespread scenario when users invest money in ideas that are never meant to be realized.

How can non-tech-savvy investors spot the signs of a scam and avoid money losses? Read this article to find out.

What is an ICO and how does it work?

First, it’s important to define how ICOs work and how they are different from traditional methods of fundraising.

An ICO is a kind of capital-raising activity in the crypto and blockchain environment. It can be compared with IPOs but in the cryptocurrency sphere. The core difference is that ICOs have removed intermediaries from the fundraising process and significantly facilitated the process for all parties.

The lack of a regulatory framework along with the general novelty of the underlying technologies makes ICOs vulnerable to fraud and cryptocurrency scams. According to the report issued by Coinfirm in March 2021, the crypto crime conducted in 2020 has totaled more than 10 billion USD. Roughly 70% of this sum has been generated by scam projects.

Scammers strategies

Scammers usually create a website, tell about their blockchain innovations and organize a tech coin ICO. The organizers of cryptocurrency fraud promise profit without extra effort. Users only need to invest in ICO tokens and sell them after a certain period.

The problem with scam coin projects is that they may look quite reliable for their supporters. The ease of devising ICO fraud schemes was even demonstrated by the SEC in 2018 as the authority released an example showing how easily users can fall prey to Ethereum scams and fake cryptocurrency projects.

The list of the most widespread scammers strategies includes the following:

- Classic exit scam. The project is actively promoted on different social media platforms, forums, channels, messengers, and blogs, and then the team of developers suddenly disappears with funds they collected from investors.

- Airdrop scam. The essence of the strategy is the stealth of private keys from users who expect to get free tokens, therefore, click on the links disclosing their private information and losing coins from their wallets.

- Exchange scam. The project launches its ICO at a fraudulent exchange.

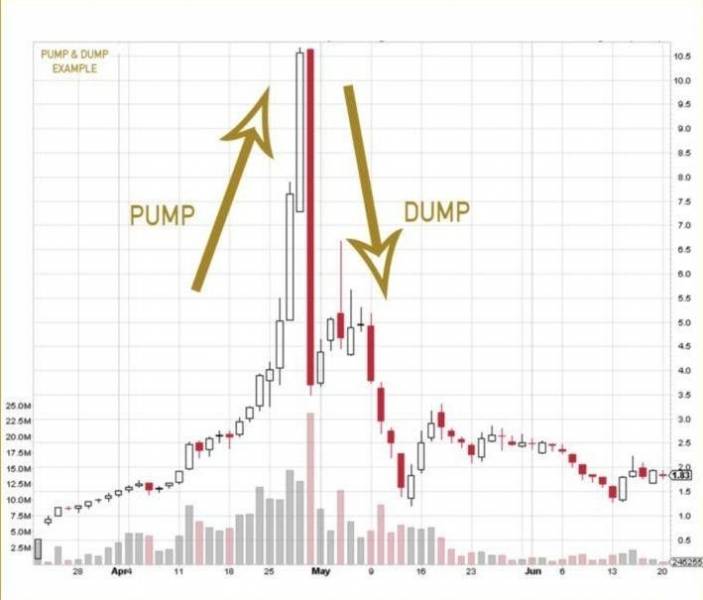

- Pump and dump scheme. The price of fake coins is inflated by scammers. Investors rush to buy the token at any price trying not to lose the opportunity of investing and then the price of tokens drops abruptly after scammers complete their sales.

- URL or phishing scam. Scammers select reputable projects and design websites with similar names to fool inexperienced investors who come to these sites and lose their assets. It is the most common scamming scheme.

It is also worth mentioning a notorious Ponzi scheme that is also often used by scammers along with those listed above.

A classic example of a pump-and-dump scheme: the price of a coin is artificially pushed upward, traders give in to emotions and lose everything when the price drops back

Ways to avoid ICO scams

So what signs should make you wary of an ICO scam? If we analyze the most famous incidents, the following common features can be distinguished:

- Lack of necessary documentation such as a whitepaper

- Lack of clear roadmap

- The reservation of a big portion of tokens for the team as well as the total lack of vesting

- Inconsistent information in different sources

- Signs of the pyramid structure

- Use of fake profiles and stock photos for the team members and advisors

- The promise of fixed profit or ROI

Sometimes scammers can copy the whitepaper of a successful project to pursue their goals. There was a fraudulent project PlexCoin that presented a convincing whitepaper that managed to raise more than 15 million USD before its activity was suspended by the SEC. Here’s what can be done to avoid money losses.

- Study the documents since there is no independent third party to perform due diligence examination and verify the coin. The ICO review site delivers a crypto ICO list that comes with ICO ratings to determine the legit coin.

- Apply to the service TokenGuard that offers smart contract audit to make sure that the project is trustworthy. Having an unbiased third party to verify the integrity of the code will surely increase your chances to avoid scammers.

- Avoid reading the marketing stuff for ICO check. Instead, the reviews of independent experts can be helpful. The reputable resources publish the curated cryptocurrency ICO list with tech details that should be analyzed thoroughly.

- One of the methods to check out the project is to explore the verified ICO advisors before investing.

- Read reliable finance blogs.

Follow these simple rules and watch out for the signs of a scam before you make your final decision and invest your money in such a risky industry.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems