Accessing broad financial services is straightforward and elementary for people who are constitutionally defined citizens of their own countries. However, for globe-trotting individuals who are always on the move, the story is a lot more different.

According to statistics, approximately 258 million folks have found residence in a nation-state which is miles away from their country of origin. As a migrant, they choose to leave home for a variety of reasons, but in their immigration, they all bring their life experiences, knowledge, culture and ambitions with them.

As they find their footing in the host country, they become financially sound individuals through acquired skill sets. Consequently, they start contributing to their families and communities in their country of origin by sending money home.

This brings the focus on the constantly rising volume of financial remittances from the 1990s to date. In 2017, migrants sent an estimated $466 billion to families in developing countries. An estimated 800 million people worldwide are directly supported by remittances from relatives and loved ones abroad, according to the International Fund for Agricultural Development (IFAD).

Talking about G20 nations, the cost of sending remittances has taken a dip for good, from a previously recorded value of 7.22% in Q4 2018 to 7.07% in Q1 2019. Amongst them, South Africa and Japan remain the costliest countries to send remittances from.

China and Brazil are the most expensive nations to send remittances to. The corresponding figures stand at 8.45% and 7.32% respectively. In terms of receiving money through cross-border transactions, Southern Asia is the cheapest and sub-Saharan Africa, the costliest.

The aforementioned numbers speak volumes about the disparity in global monetary transactions, which need immediate, speedy redressal. For cross-border remittances to be truly effective, the associated price of the procedure needs to go down significantly, and the idea has somehow began taking shape.

There are now more than 3,000 remittance services providers worldwide, according to IFAD, and a shift from the usage of banks to less costly Money Transfer Operators (MTOs) has thrown the sector into a state of flux.

New platforms such as online transfer services, digital wallets and mobile money applications, combined with new technologies such as cryptocurrencies, have created greater competition and transparency within the remittance transfer market.

Keeping aside the security, and fraud perspective, these solutions have truly stood true to the stated promise of eliminating global money transfer woes.

But while expats have found solace in avant-garde methods of cross-border finance, students living across countless foreign geographies continue to bear the brunt of limited economic opportunities. For starters, quite alot of times, a student doesn’t have proper documentation and credit history to open a bank account. Other reasons why such is the case:

- Lack of adequate financial liquidity;

- Doesn’t feel the need for a bank account, as it is an expensive premise.

Secondly, banks continue to be the costliest RSP (Remittance Service Provider) type with an average 10.9% cost in Q1 2019, Post offices are recorded at 7.62% for the same quarter. Money transfer operators (MTOs) land at 6.06% while mobile operators are the cheapest RSP type with an estimated 2.92% cost.

Banks, MTOs, and post offices continue to exorbitantly charge high transfer fees with equally astronomical conversion rates.

However, in this stressful scenario, there is a silver lining. A relatively young but state-of-the-art technology which can put to rest all the aforementioned pain points.

Blockchain, a system of distributed bookkeeping which powers cryptocurrencies posseses excellent capabilities to process international payments at record speeds, whilst its secure structure promises to reduce instances of fraud and offers levels of “permissioned vs permissionless” privacy.

Depending on how it is used, customers may not necessarily even need to know when a blockchain solution is being used.

Blockchain is a great solution to this problem as it offers-

- Instant transfers

- Low transaction fee

- Security

Although blockchain has demonstrated potential to make life easy for overseas students, transacting with currencies running on them (cryptocurrencies) can be risky and painstaking due to their towering volatility.

Enter stablecoins, essentially cryptocurrencies but ones which provide the advantages of blockchain technology combined with the trust and stability of traditional fiat/national currencies.

Stablecoins are pegged (or linked) to national currencies like USD, EUR, CNY or JPY and sometimes to real-world assets like gold or oil. This is to keep their value stable unlike the price of popular digital assets like Bitcoin or Ethereum which keeps varying every time.

Advantages of stablecoins:

- Stability in trading from the comfort of your smartphone

- Easy liquidation for traders & investors in a situation of market collapse

- Insulation from sporadic volatility

Primarily there are 3 kinds of stablecoins:

- Fiat-collateralized

- Cryptocurrency-collateralized

- Non-collateralized (algorithmic)

Out of these 3, a fiat-collateralized stablecoin is the most basic and simple form of this cryptocurrency. A central entity (or custodian) puts up an amount of fiat currency as collateral, and a stablecoin is issued against the fiat currency at a 1:1 ratio. This form of stablecoin should, in theory, require a periodic audit to ensure that it is truly collateralized.

Stablecoins could remove bottlenecks and deeply ingrained inefficiencies in systems concerning remittances, salaries, wealth management, trading, lending, store of value, etc.

The issue of high remittance fees may well be solved by stablecoins, provided that the user experience involved can rival that of existing players in the market.

That’s where Aximetria comes in. A Swiss fintech company founded in 2017, Aximetria is committed to promoting banking without borders and providing Swiss-level banking service to global consumers in Europe, Africa, Asia and Latin America.

As CEO, Alexey Ermakov puts it, “Stablecoins are definitely not the “get rich quick” sort of cryptocurrencies or as digital assets are normally perceived to be, but they hold indispensable value as far as factors as ownership exclusiveness, and inexpensive transactions are concerned.”

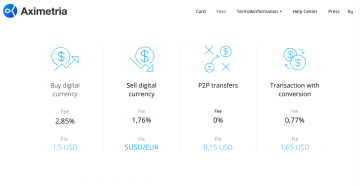

The company recently announced support for Gemini USD (GUSD) & Statis (EURS) stablecoins in its state-of-the-art financial asset management app. Unlike other European neo-banks offering traditional currencies only to Europeans, Aximetria continues to adhere to the policy of providing high-quality, stable and secure financial instruments globally. Furthermore, Aximetria will support all popular stablecoins in its application by mid-2019.

This year the company will also extend its services to B2B payments on the basis of stablecoins, freeing businesses of a number of restrictions and limitations. Aximetria users will be required to go through a remote verification process (KYC), after which they can buy or sell global currencies using any bank card. They can also securely store and exchange other currencies. Adding stablecoins is the next step in the company’s strategy to combine innovation and the highest level of security so inherent in financial Swiss services.

Additionally, the company intends to gradually make internationally monetary transfers totally free of cost. Similar to the fee model followed on the Ethereum blockchain, stablecoins can help achieve near null transaction fees a reality, and Aximetria is working tooth and nail to ensure that.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems