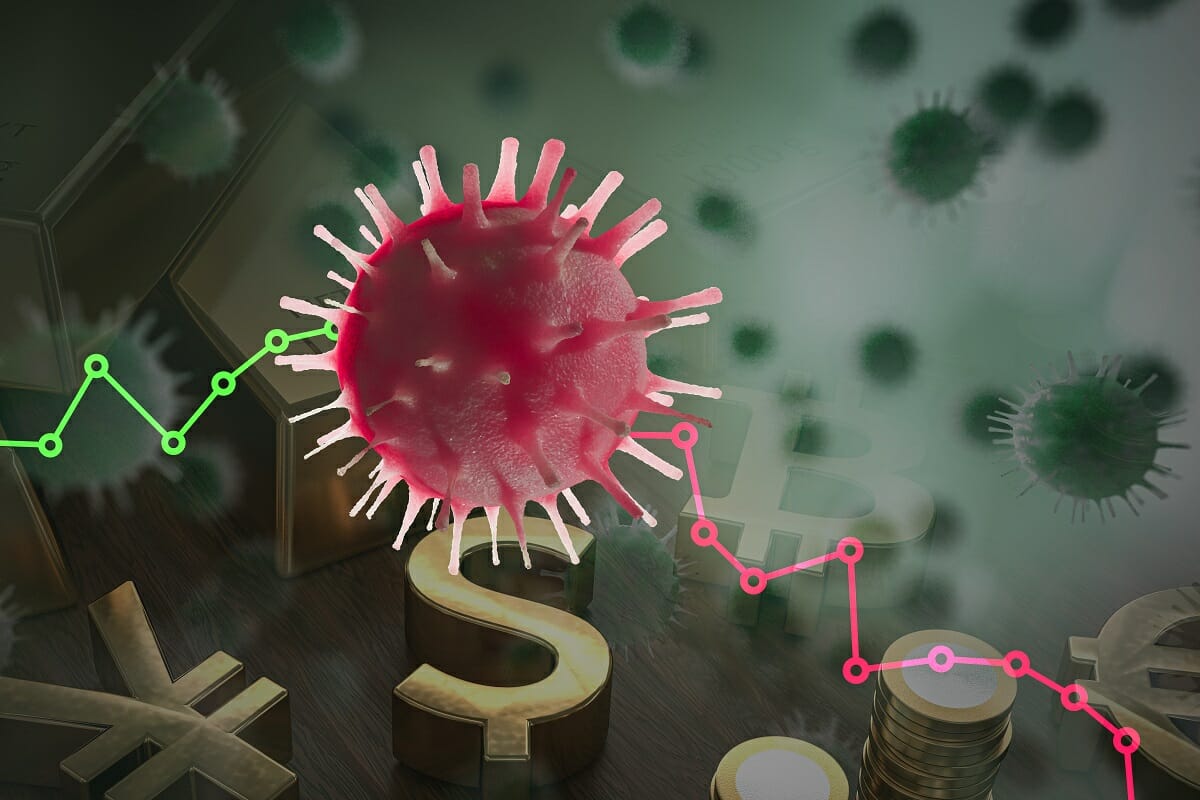

The novel coronavirus or COVID-19 has made an indelible mark on the world. Only a few months after the virus was first discovered in Wuhan, China, it spread around the world. Communities are becoming isolated as social distancing measures take place.

Other hard-hit areas of the world include South Korea, Italy, and the United States. In the United States, local disease clusters such as those in Boston, New York, and Seattle are becoming more widespread.

Market Traders Institute explores the financial impact that the coronavirus is having around the world and shows that there is an opportunity for savvy investors to take advantage of this uncertainty.

Effects of the Coronavirus

The coronavirus has already made an indelible mark on daily life around the world. While the significant containment measures used in China and Italy have had some beneficial effects, the impact of the coronavirus has spread to many other parts of the world. Governor Cuomo of New York has instituted containment zones in the state as well.

Large business meetings, festivals, and concerts are being canceled or postponed. Many companies have required that their employees begin working at home to help prevent the spread of the disease.

American colleges and universities are closing their doors and instituting virtual learning for the rest of the spring semester. This will cause a severe impact on the workers at these colleges and on the support businesses that have grown around them, like restaurants and shops.

Financial Impacts

Many companies’ bottom line is being hit hard by the coronavirus. Multinational corporations doing business in China and South Korea are especially hard-hit, with workforces largely out of commission for the past two months. The coronavirus hit heavily industrialized parts of China and South Korea. This means that the world’s supply of raw materials and consumer goods is depressed.

Another key effect of coronavirus is the restriction of global travel. This is hitting airlines, hotels, and restaurants in many cities around the world. Employees of hotels and restaurants are generally paid on an hourly basis and receive no paid sick leave. While some American companies like Darden Restaurants and Walmart have begun instituting paid sick leave for their hourly employees, they are the exception and not the rule.

All of these events have plunged the stock market into a state of uncertainty. The Dow Jones Industrial Average has plummeted over the past several weeks, reaching its largest daily point drops since the 2008 recession.

The Fed Rate Cut

The primary impact of the coronavirus which investors should be concerned with is the Fed rate cut. Coming nearly three weeks early, the Fed cut 0.5 percent from its rates, followed by a second emergency cut to zero. Other countries’ national banks like the Bank of England followed suit.

The desired effect of the rate cut is to encourage investment in business. When borrowers can get more credit at a lower price, they are more likely to invest in large projects. The Fed rate cut is also passed down to the consumer in the form of adjustable mortgage and credit card rates, as well as home equity rates. This will encourage consumers to buy homes, remodel existing ones, and spend more money in general, helping to stimulate the economy.

A Time to Buy

While the markets are low, there is a major opportunity for investors to snap up commodities and stocks which are undervalued. This sets the current situation apart from a true bear market, assuming that the condition of the markets is temporary and does not fall much further.

Much of the work in investment involves predicting the large-scale movements of the markets, and experienced firms like Market Traders Institute have their finger on the pulse of the economy.

Protected Areas

As the price of other commodities falls, certain investments have begun to gain in value. Gold, already a solid investment, has not dropped since the coronavirus was first detected in China. Investing in gold means that traders will have a hedge against volatile prices in other areas.

It is also possible that cryptocurrencies like Bitcoin can be hedges against dropping prices in other sectors. While Bitcoin has lost money since the coronavirus began, it has not plunged in the way other securities have.

Final Takeaways

While the coronavirus is a severe global problem, it does not have to mean financial ruin for investors. If investors are smart and choose their securities carefully, they will be able to take advantage of market conditions and make money. During a stock sell-off, prices are low and traders can get excellent bargains. Plus, many forex traders are using this extreme volatility to their advantage.

It is difficult to say how much the coronavirus will continue to affect the financial markets in the months to come, but savvy investors like Market Trading Institute will be able to rise above these problems and preserve their wealth.

This is an article provided by our partners’ network. It does not reflect the views or opinions of our editorial team and management.

Contributed content

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems