Mergers and acquisitions are important strategies for companies to grow their market share, increase profitability, and access new resources. However, companies need to consider key factors before pursuing an M&A to ensure a successful transaction.

Strategic Fit

Strategic Fit

The primary reason behind M&As is to create a strategic fit between the two companies. Companies need to analyze the potential benefits of merging or acquiring another organization, such as reduced costs, improved competitive positioning, synergies from combining operations, etc. It is important for companies to ask themselves if the M&A makes sense for their business objectives and long-term goals.

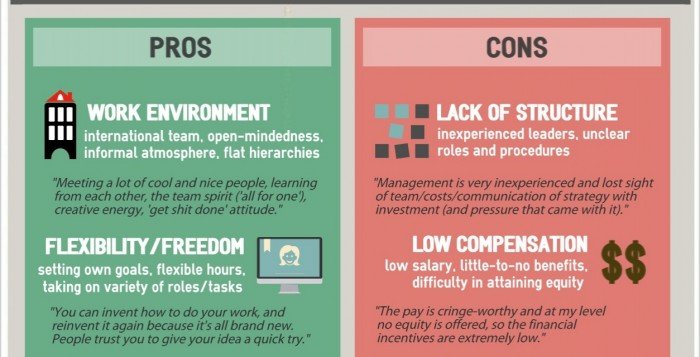

Culture Fit

An important element that often gets overlooked by companies considering M&As is culture fit. Organizations must ensure sufficient cultural alignment between each side so that both teams can work together harmoniously after coming together. Each party should conduct detailed research into their respective cultures, including analysis of leadership styles, mission statements, security, organizational behavior principles, etc., so that they have a clear understanding of how integrated results for merged entities could look like without compromising on team morale when going through integration changes processes post-merger/acquisition.

Financial Due Diligence

Companies must thoroughly assess a target company’s financial statements, assets, and liabilities, cash flow patterns, as well as identify any contingent liabilities or obligations associated with the company. This will help them determine if there are any financing needs and establish the fair market value of the target business.

Legal Due Diligence

Legal due diligence is essential in assessing potential legal risks related to an acquisition or merger before proceeding with the transaction. During the legal and due diligence process, both parties should go through all documents related to contracts, intellectual property agreements, and regulatory requirements applicable to state and federal laws on M&As that may affect the proposed transaction process.

Secure Data Sharing

The exchange of confidential documents and information between parties involved in an M&A requires secure data-sharing platforms like Virtual Data Room (VDR). A virtual data room for M&A provides a secure online platform with access controls enabling users to securely upload documents to be shared with other participants while preventing these files from being leaked outside the network. They also allow users to manage which participants can view which documents within certain timelines so that no sensitive information is disclosed prematurely during their negotiations or purchase process.

Change Management

Cultural differences between the merging parties often present challenges in integrating the post-merger teams. Companies should consider conducting change management training sessions with the merging teams to create a positive mindset around merger and acquisition processes. This will help them better absorb change and adopt new concepts that may come up due to integration.

Internal Communications

Internal communications is another area that needs to be thoroughly analyzed before executing a merger or acquisition. Executing the entire process in secrecy is not ideal, as it can negatively affect businesses. Companies must ensure that their employees are well informed about the M&A and regularly updated about its progress. Achieving this requires the internal communications team of both parties to be involved in M&A integration efforts.

First-mover Advantage

M&As often present an opportunity to acquire a company that will ensure your company has a first-mover advantage in the market before competitors. M&As tend to be an expensive process with high risks. Companies need to plan their M&A carefully so they don’t unintentionally leave the first mover advantage behind and end up wasting resources.

Governance

Governance is another important area that needs to be thoroughly reviewed during M&As. Governance is critical in ensuring that organizational governance is compatible with the new organizational structure. M&As often involve changes in board members, managers, and employees of both parties, which must be addressed carefully by legal and financial diligence teams to determine any potential issues before proceeding.

Performance Management

Companies need to understand the performance management systems of the target company that the M&A will impact. This will help them determine if any performance management issues need to be addressed. Once executed, companies must regularly monitor performance and make necessary adjustments to ensure that their M&A goals are still being met post-merger/acquisition.

Overall, mergers & acquisitions involve high risk and complexity. Still, they can yield significant rewards if executed properly, allowing efficient use of resources while minimizing risk factor exposures resulting from poor due diligence processes before concluding deals regarding ownership changes involving two sides. Considering these aspects, the prior pursuit of mergers & acquisitions transactions can help organizations increase the success rate while identifying potential upsides associated with future partnerships resulting from integrations such transactions entail.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems

Strategic Fit

Strategic Fit