Bitcoin, which was invented 10 years ago, led us at fast pace to the blockchain, considered now as one of the most important technological revolutions of the last decade. Even though blockchain is still at its infancy, its evolution has been fast paced, fitting the speed of current times. This complex technology triggers the curiosity of many, still having to come to grips with its more fundamental concepts. Recently, CB Insights, released an interesting and accessible report about blockchain trends in 2019. The trends were identified using CB Insights NExTT framework. In this article we explore some of those trends

What is NExTT

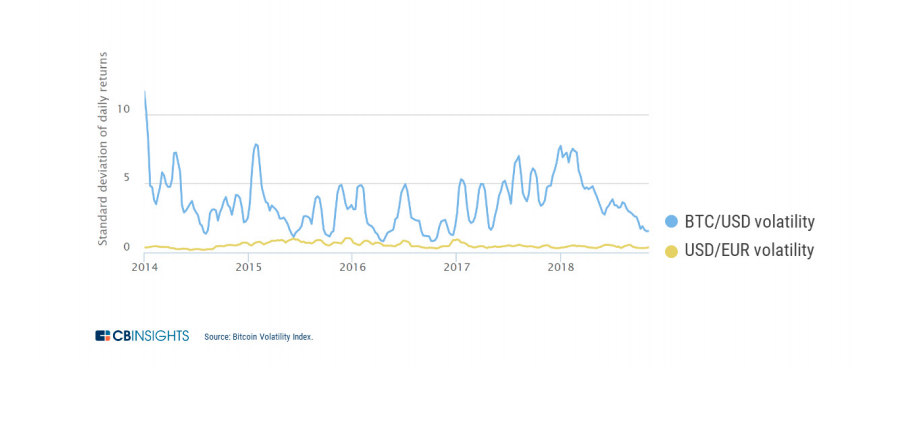

NExTT is an acronym for 4 words: Necessary, Experimental, Threatening, and Transitory trends. These are considered to be the four stages of a trend as it evolves throughout times.According to CBInsights, the Necessary trends are the ones about fiat-crypto exchanges, bitcoin mining and custody.

Fiat-crypto exchanges

We all have seen how crypto prices have fallen in 2018, so a possible alternative could be fiat-crypto exchanges. Most people arrive to the crypto world through an exchange. According to CB Insights: “By enabling trade in and out of fiat currencies, exchanges act as “on-ramps,” bridging the worlds of cryptocurrencies and more traditional finance. “

The report highlights Coinbase which has emerged as the most popular exchange in the US. It had a recent valuation of $8B valuation and has been able to secure large sums of venture investments. But crypto exchanges have seen their respective revenues fall quarter-over-quarter, so they have launched new trading products (especially for larger, institutional investors), and investing out of newly-formed venture arms.

The expected trend for 2019 will be that major crypto-fiat exchanges will have to “fend off competition from larger, more traditional players.” The question then will be if big financial firms will take over from here, or not. Another important question is if fiat-crypto exchanges will find a business model that doesn’t rely exclusively on speculation to drive revenues.

Bitcoin Mining

Mining companies are facing increased competition and decreased demand. Paradoxically it is bitcoin mining companies like Bitmain the first blockchain companies to go public.

But environmental concerns are rightfully hitting mining companies, Bitcoin uses a “proof-of-work” consensus mechanism to secure its blockchain, that depends on a tremendous amount of energy consumption. The good news is that developers are building other consensus mechanisms, such as “proof-of stake”. If more blockchains opt to use proof-of-stake to achieve consensus, mining companies could loose revenues.

Interestingly CBInsights reports mentions how mining companies are expanding into other sectors to keep up with the downfall. In November, bitcoin mining giant Bitfury raised $80M to expand into “adjacent markets” like artificial intelligence, and Bitmain has also said that it’s looking to AI as an area of expansion.

Custody

Another issue tackle by the report, which is considered necessary, is “custody”, ie the ability of financial institutions to hold cryptocurrencies on behalf of trading clients. This seems to be a difficult problem to get sorted.

Bitcoin and other cryptonetworks generally work like a digital safe deposit box — access is controlled by a private key (a long string of numbers that allows an owner to access their crypto holdings). Anyone with access to the “private keys” — the owner, a bank, or a hacker — has total control.

If we now think about this process at a large scale, it implies that banks must figure out ways to keep private keys in the right hands. This will happen, sooner or later, as there is now widespread acceptance by finance executives that cryptocurrencies will be part of the future of finance. This implies that the necessary custodial infrastructure needs to be build. That is mandatory, if cryptocurrencies get their much wanted mainstream adoption.

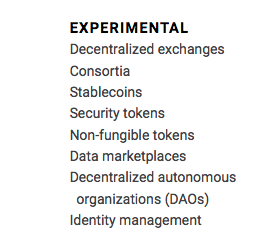

About the Experimental Trends, CBInsights outlines the following:

Decentralized exchanges

“The regulatory clampdown has cast uncertainty onto how decentralized exchanges will operate in the near term.” says the report. As SEC’s cyber unit chief recently said, “using any blockchain to create an exchange without central operations doesn’t remove the original creator’s responsibility.” The future of decentralized exchanges will thus have to cope with securities laws, KYC/AML, and a dialogue with regulators, which is good news! In the near future, we will almost certainly see the appearance of a decentralized exchanges.

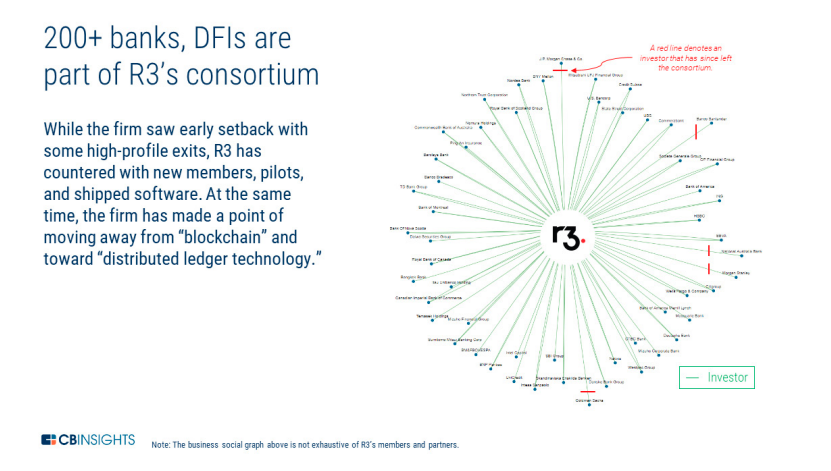

Consortia

In theory, consortia bring competitors together to collaborate. Theoretically, that is the ethos of blockchain. But in reality, that necessary consortia hasn’t quite happened yet. The report give us the examples of DLT consortia such as R3, Hyperledger, and the Enterprise Ethereum Alliance, but highlight how their offerings are limited and their adoption quite small.

Fostering cooperation between competing organizations remains a challenge. Theoretically, its part of the DLT and consortia to establish ways of cooperation. But in reality, if distributed ledgers are collaborative, competitors are competitors! Another problem on the road for better consortia is to integrate DLT into existing IT coming from the past and that isn’t easy.

The example provided in the report about Consortia comes from IBM.

“IBM’s distributed ledger service, IBM Blockchain, utilizes Hyperledger, which is an open-source consortium developing industry-specific distributed ledger frameworks. IBM has worked with big corporate players like Walmart, Kroger, and Nestle to integrate distributed ledger solutions, most notably for supply chain management. Larger companies like these have leverage over suppliers, and can likely mandate adoption of their distributed ledger projects.”

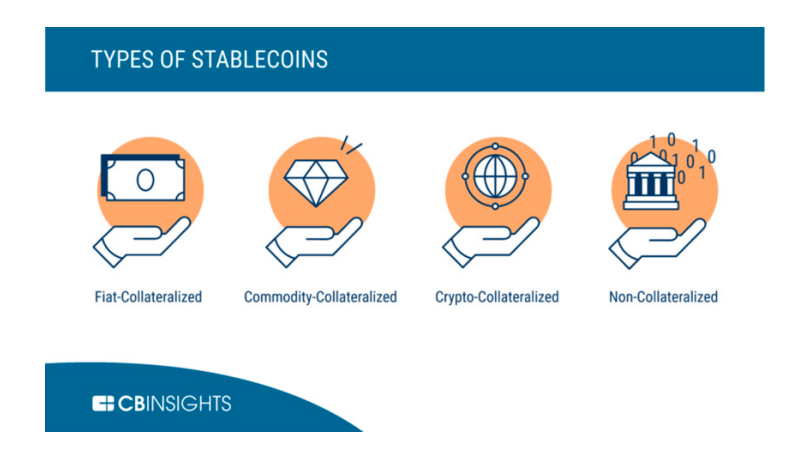

Stablecoins

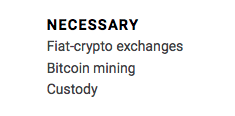

Bitcoin’s volatility has made head news almost everyday of 2018. Its price moved from almost 20 000 USD in December 2017 to 4000 in November 2018. Experts state that more stability, is necessary to foster the mainstream adoption of cryptocurrencies. That is not the case currently, as in sharp contrast to bitocoin, gold averages about 1.2%, and major fiat currencies average 0.25% – 0.75%.

Stablecoins could be the solution. These are cryptocurrencies optimized for stability. Currently we have around 60 stablecoin projects, which have received more then $350M in financing.

The largest stablecoin is fiat-backed Tether (USDT), with a market capitalization of $1.7B (as of 11/19/18). To maintain its stability, Tether claims that all issued USDT are backed one-to-one by bank-held US dollars. That claim has been repeatedly called into question. Further, USDT remains most often used for cryptocurrency trading, not commerce.

Tether cryptocurrency is controversial because of the company’s failure to provide a promised audit showing adequate reserves backing Tether. There are claims that Tether had an important role in manipulating the price of bitcoin, and there is lack of clarity about relationship with the Bitfinex exchange, and the company’s apparent lack of a long-term banking relationship. Other alternative to stable coins remain to be seen.

Security Tokens

Security tokens are assets that are “tokenized” — digitally represented — on a blockchain. These are different than utility tokens popularized in the recent ICO boom-and-bust, which which allow users to interact within networks. Most importantly, security tokens are subject to securities regulations, like stocks, bonds, and other types of securities, so they are safer.

The report mentions how security tokens are advantageous since they are programmable.

“Since these securities are tokenized on a blockchain, “smart contracts” can make them act in a certain way, without the use of a third party. For example, a loan “tokenized” on a blockchain could automatically make payments without the use of a traditional middleman like a bank. At the same time, migrating real-world assets to a blockchain and satisfying various stakeholders is difficult.”

Security tokens can be quite promising, but still need to sort out problems similar to the blockchain consortia namely, establishing cooperation and collaboration between long-standing stakeholders with differing incentives.

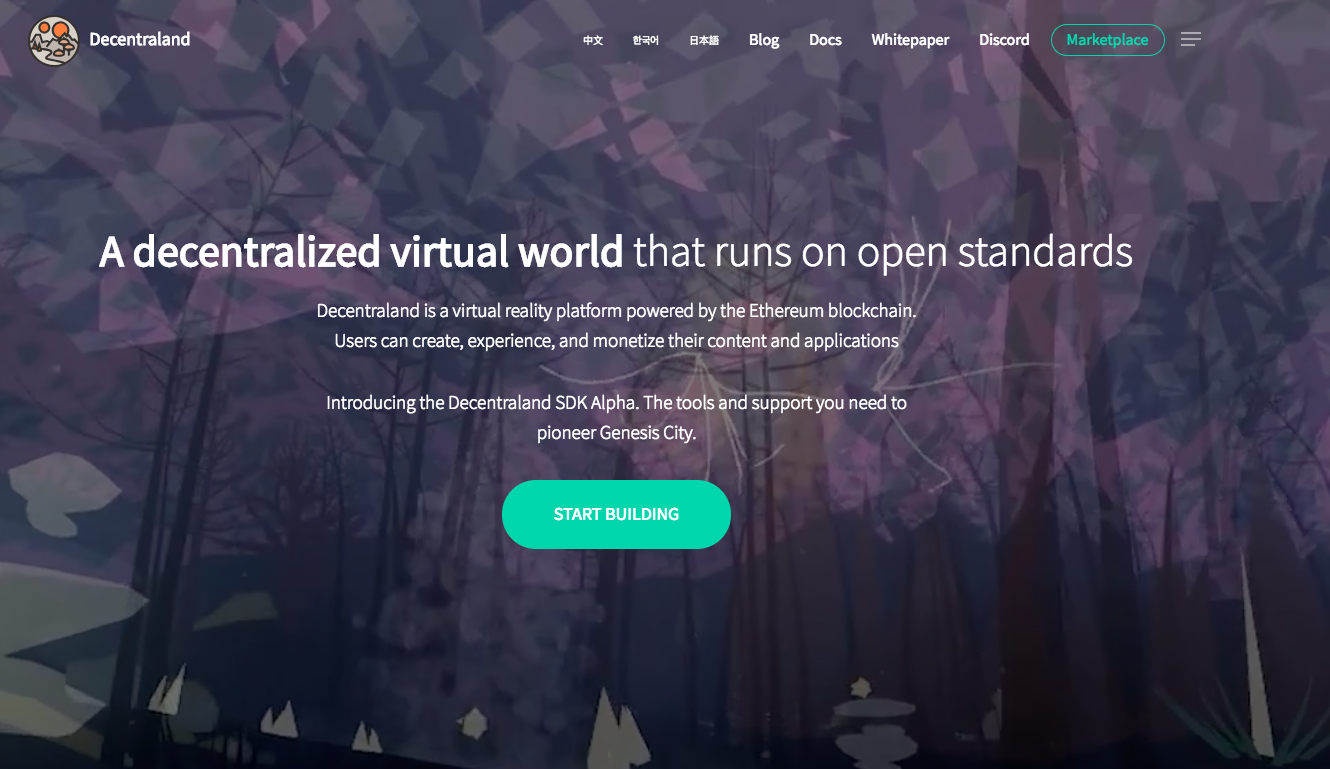

Non-Fungible Tokens

Non-fungible tokens refers to unique, blockchain-based tokens that are distinguishable from one another. An example are diamonds. Diamonds are not fungible, because they are radically different from one another. In contrast, fiat currencies as well as some more typical cryptocurrencies, are “fungible.” One US dollar will always be equal to another US dollar.

The proposal of NFTs is to establish digital scarcity online. The digital world has been quite distinct until now. as the internet has made it easy to copy digital images, music, or text. NFTs could allow for unique digital ownership, using public blockchains as ledgers of record. If this is a good beneficial trend or not, remains to be discussed…

For now, digitally scarce, unique tokens are finding their first use case in gaming. An example is decentraland, a virtual reality platform.

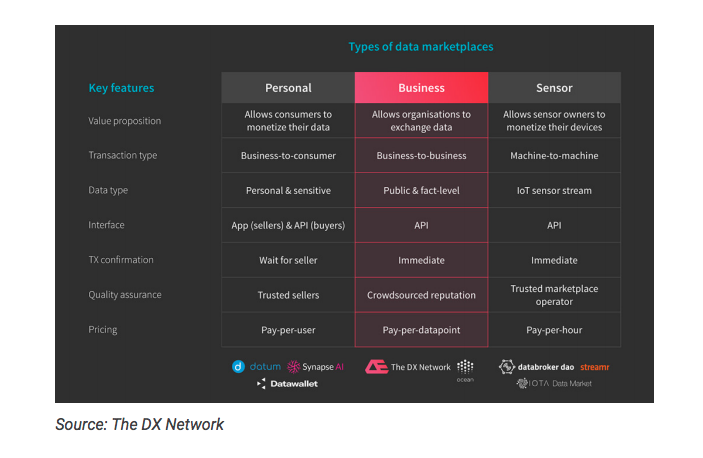

Data MarketPlaces

Data is considered by some as the new oil. AI depends on massive numbers of user data to create its applications. For example, Google uses deep learning to tweak its ranking algorithm. The easy access to users data by tech giants such as Facebook, Amazon, Microsoft, and Apple (FAMGA) and China’s Baidu, Alibaba, and Tencent (BAT) transforms them in leaders in the field of AI. But what about smaller companies ? And how is your personal information being used as data ? Blockchain could give individuals the ability to control and sell their own data. Emerging blockchain startups proposing “data marketplaces” could be a possible solution to democratise this sector. For example, “Users could share data with advertisers on an as-needed basis. enomics companies could give contributors “royalties” for sharing their genomes.”

Maria Fonseca is the Editor and Infographic Artist for IntelligentHQ. She is also a thought leader writing about social innovation, sharing economy, social business, and the commons. Aside her work for IntelligentHQ, Maria Fonseca is a visual artist and filmmaker that has exhibited widely in international events such as Manifesta 5, Sao Paulo Biennial, Photo Espana, Moderna Museet in Stockholm, Joshibi University and many others. She concluded her PhD on essayistic filmmaking , taken at University of Westminster in London and is preparing her post doc that will explore the links between creativity and the sharing economy.