The main problem for governments, on the aftermath of the crisis is all the obstacles the money has to avoid in order to reach people’s hand. One of the causes of the last crisis was the total paralysis on households spending and businesses access to loans or credits.

But because money creation is based on debt, although, some actions were taken in the UK to get over the crisis, most of them were related to boost the spending and the credit, with the subsequent peril of growing both household and business debt.

The main solution used by governments was the Quantitative Easing mechanism.

This is an attempt made by governments to have more impact -and control- over money creation schemes. Quantitative easing involved the central banks buying part of the government’s debt after it was issued (and so didn’t directly affect government spending at all). QE injected its newly created spending power into the financial markets, relying on indirect effects to boost spending in the real economy.

Unless the increase in spending incentivises large amounts of business investment, the private debt-to-income ratio is likely to increase further, setting the stage for a future crisis and/or recession.

That is why policymakers are currently faced with a dilemma: the strategy of fuelling growth through increased borrowing by households, to fuel economic growth is likely to be unsustainable. The alternative approach though – fiscal policy – was, and is, constrained by political beliefs about the appropriate response to public deficits.

Following the idea highlighted in the Part 1 of this review, the Think Tank Positive Money bets high on an alternative solution to avoid banks mediation in the creation of money. They called it Sovereign Money Creation.

They define the revolutionary idea as it follows:

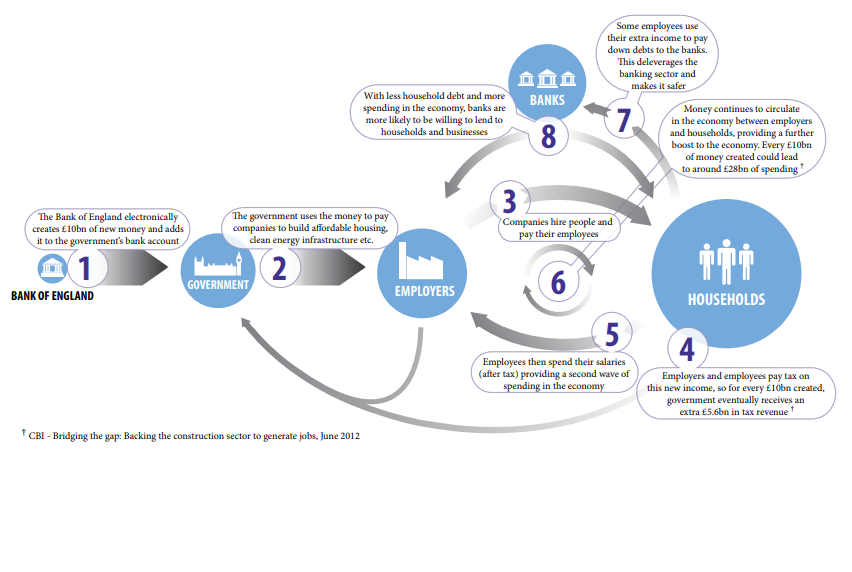

If an increase in spending is desirable, the government and central banks can work together to increase spending and therefore GDP. Rather than attempting to get the private sector to increase its spending, the Bank of England could instead partner with the government and use its capacity to create money to attempt to increase the government’s spending instead. The Bank of England can do this by creating money and, rather than using it to buy pre-existing financial assets (as was the case with QE), instead grant it to the government. Because this process involves the creation of money by the state (rather than by commercial banks), we can name this process “Sovereign Money Creation” (SMC).”

The government could then use the money for several purposes:

- It could use the newly created money to directly increase its spending

- It could temporarily reduce taxes, using the money to compensate for the lower tax revenue (keeping its total income constant)

- It could distribute the money directly to citizens in the form of a “citizen’s dividend”.

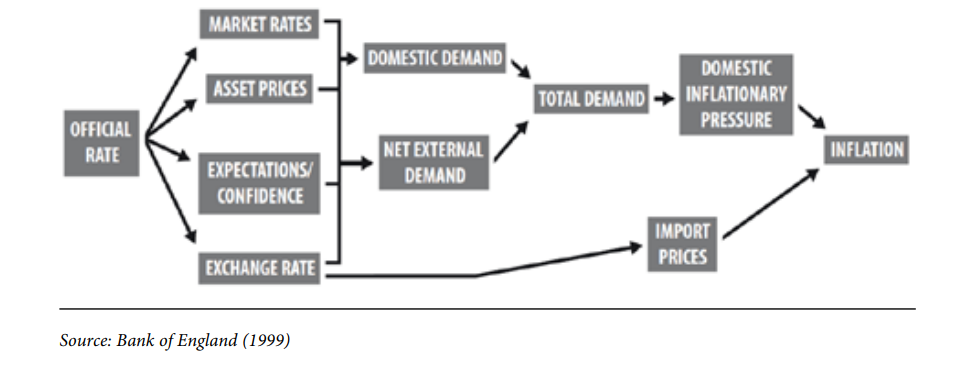

Governance and control in the SMC: Avoiding the Inflation Shadow

To control some sort of abuse that could happen, SMC could lead to different risks. If governments can create money at will, prices could rise quicker as that money is not linked to economic flows, resulting in high inflation rates. Other perils could be related to loss of value and abusive political control over money creation.To avoid that, Positive Money suggests that, it is important that politicians are not directly given control over money creation, because of the risk of political pressures leading the government to abuse its power to create money. Therefore, the decision over how much new money to create should be taken, as it is now, by the Monetary Policy Committee (MPC) at the central bank in line with their democratically mandated targets.

“Likewise, the process should be designed so that the central bank is not able to gain influence over government policy. In practice this means that the MPC and the Bank of England should not have any say over what the new money should be used for (this is a decision to be taken solely by the government) whilst the government should have no say over how much money is created (which is a decision for the MPC).”

A tool to skip the next Crisis

Positive Money also focuses on the idea of how this Sovereign Money Creation could serve to avoid the increasing debt-to-income ratio which is leading us to a new crisis. They call it an important “macroprudential” tool in the long term. “SMC can be used to ensure that aggregate demand is maintained even as other monetary polices – such as countercyclical capital buffers – are used to restrict bank lending and prevent an unsustainable boom from continuing. This means that there would no longer be a trade-off between financial stability and economic growth.”

Recent economic figures suggest that government policies (such as Help to Buy) have finally been successful in encouraging households to borrow more, mainly for mortgages. This has led to an increase in house prices, and a subsequent increase in spending due to the ‘wealth effect’.

However, while economic output is increasing, the expansion will not be sustainable if private debts continue to increase at a faster rate than private incomes. The search for a sustainable monetary system shouldn’t be something lesser than mandatory in our current economy after having suffered one of the worst financial crisis in decades. Simply put, governments and national banks have done little but patching up the economy to get it back in track towards the always growing schemes.

Sovereign Money Creation is an alternative, a real one, to make the changes and avoid an already warned new crisis. Relying on banks didn’t work in the past, and is likely that will not work in the near future.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist, he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.