Digital Innovation, Fintech, decentralised technologies and crypto currencies also known as digital currencies are here to stay. The cryptocurrency market as we speak is a $1,6 trillion ecosystem that no one can ignore in the context of a $80 Trillion GDP world economy.

Context Digital Innovation, Fintech, decentralised technologies and crypto currencies

Major global banks are using crypto currencies and blockchain related technologies. There is a major transition going on in the financial and banking industries that will be completely disrupted. Major banks and financial institutions started already adopting cryptocurrencies. An example is Protego Trust Bank, enabling institutions of all sizes to safely interact with digital assets of all types.

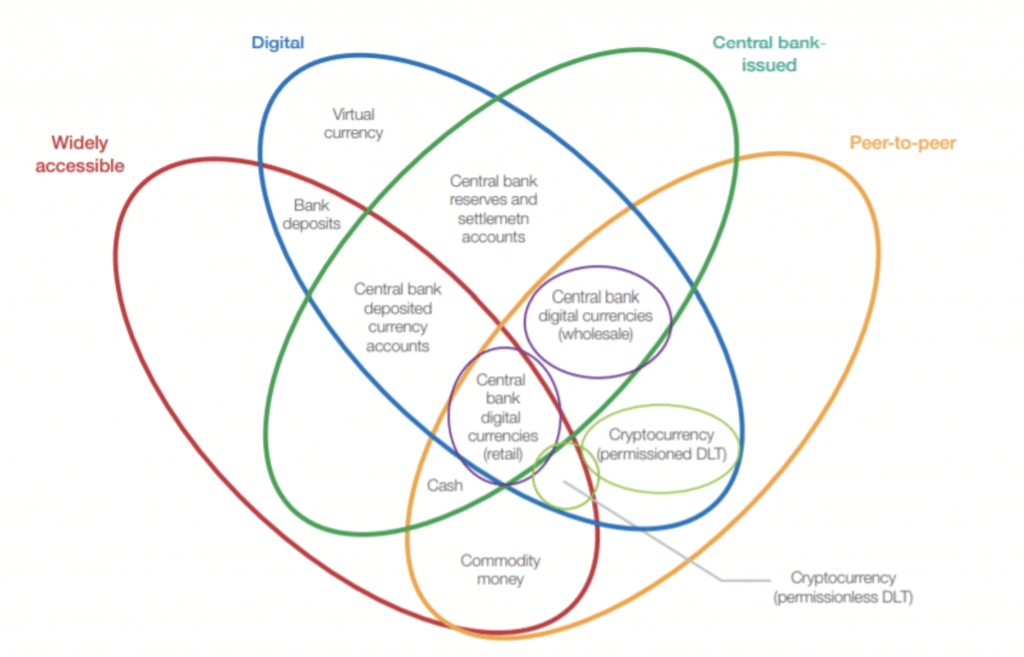

Retail-banking clients and institutional investors are expressing increased interest in these areas and the use of digital currencies as an innovative financial vehicle and in the distributed-ledger technology (DLT) that underlies it: particularly innovations such as blockchain.

The majority of investors, fintechs, and venture capital funds are making a sustained commitment to cryptocurrency, regarding it as the future of money. Banks, financial organisations and central banks can no longer afford to ignore this challenge and also the opportunity.

Of course, this represents a new innovative area of finance and money with many organisations having reasons to be cautious. We have seen how some major governments, regulators and financial services leaders, remain skeptical of the value that cryptocurrencies and digital assets have as an asset class, since individual cryptocurrencies have lost, at times, significant market capitalization (including this year).

During 2020 and especially the early months of 2021 -within the COVID-19 crisis context-, cryptocurrencies have experienced volatility, and their reputation has been influenced by their association of Bitcoin, the most prominent cryptocurrency, and with criminal acts such as the Twitter hack of July 2020. But in parallel with the endorsement of Bitcoin by the likes of JP Morgan and industry leaders like Jack Dorsey and Elon Musk, no one can ignore this.

Cryptocurrencies are a fast-growing sector with great and challenging prospects. But they also offer major opportunities when used wisely and if governments and their regulators’ work are aligned with entrepreneurs and investors to create sandboxes, in order to educate themselves, the market and to raise awareness of risks and opportunities.

Cryptocurrencies and decentralised finance (DeFi) platforms are now outperforming conventional banking products while offering greater efficiency, less bureaucracy, and more transparency.

Major financial organisations and banks are launching a variety of digital assets and specific cryptocurrency offerings. Some of the major solutions include processing payments, providing escrow services, facilitating international cash transactions, helping customers exchange their money for bitcoins, and even making loans in this currency.

Major Global Governments, Central Banks and Banking institutions using Cryptocurrencies and blockchain

As our global digitally transforming modern society transitions to a global, fully digital economy, blockchain 360 technology solutions represent a key tool for third-world and developing economies to transition to be more digital to keep pace with their established first-world counterparts. This benefit is particularly impactful in areas, currently dominated by fiat money where there is a bridge with the increased expansion of cryptocurrencies growth and maturity adoption.

Cryptocurrencies are a fast-growing wave and their adoption is driven by fragile financial systems, corruption of failed fiat currencies, hyperinflation, and inadequate regulation. It can also make a substantial difference in underrepresented financial locations with large numbers of unbanked citizens and where there is a lack of global banking infrastructure.

Governments control the economy through central banks, for example the U.S. Federal Reserve a.k.a the Fed which controls the economy through a relatively arcane system in which it tweaks interest rates to control the money supply. It’s a multi-step process that attempts to influence spending and saving behavior by consumers and businesses. But since financial resources are held by private institutions, the ultimate effects of the Fed’s decisions are filtered through these other organizations.

Central Banks Digital Currencies therefore are the only way to go as the financial economy and all its industries become significantly digital. The major upside of a Central Bank’s Digital Currencies is that central banks would be able to directly change the interest rates on the currency, meaning it’s incentives for saving and spending would pack a much bigger punch. And not just that, it could easily turn the interest rate negative — something central banks can’t really do now — when it really needed to stimulate growth.

After the challenges with the economic instability, financial crisis and the ensuing global economic slowdown, especially now with Covid 19, these measures did not prove to be terribly effective at stimulating growth. Giving central banks the ability to aggressively drive the economy through the control of their digital currency will make a major impact in people, organisations and governments. But this will imply a much bigger level of collaboration, education, and training with continuous innovation and training.

Major global banks like JPMorgan Chase introduced crypto currencies products and services and they even developed and offered their own cryptocurrency: the JPM Coin. The JPM Coin usage is primarily for funds transfers and for faster transaction settlements amongst clients. Morgan Stanley has offered blockchain-based investment products since 2018. Goldman Sachs introduced a new leader for oversight of digital assets in recent months, an indication that it expects activity to increase.

Likewise, more than 100 banks have tested instant payments with the use of the cryptocurrency Ripple.

The Chinese Central Bank has already started the roll out of its digital currency. China is home to many cryptocurrency projects and exchanges, and yet, has been having a double relationship with crypto that has actually been banned for several years now. In 2017, the People’s Bank of China, the nation’s central bank, banned initial coin offerings and cryptocurrency exchanges but in parallel was very receptive to blockchain technology.

At the end of July 2019, a cutting edge chinese national project known as the Blockchain Service Network, or BSN, was launched to support medium-sized businesses in the development of blockchain operation alliances and creating projects through public blockchains that will comply with Chinese law and operate internationally. The Chinese Central Bank also announced that the BSN will integrate support for stablecoins, albeit no earlier than 2021, as the infrastructure for the digital yuan.

In Europe, the European Central Bank has started setting up a task force to explore offering a digital euro. In this regard, the ECB states that they are doing it “not because we want to keep up with fashionable trends,” says an ECB executive board member Yves Mersch, “but because we have to be ready.”

Other central banks, like Sweden and the Bank of England have indicated interest in cryptocurrencies as well.

The biggest challenge when it comes to cryptocurrencies is not about how to stop the waves but how to ride them. The central banks that will ban crypto transactions will be at odds with their government’s goal to build quickly their digital economies around blockchain technology.

Case Study: Cryptocurrency Ban in Nigeria

Out of 74 countries in the Statista Global Consumer Survey, the Nigerians were the most likely to say they used or owned cryptocurrency. Most studies around crypto usage around the world suggest that Nigeria is the second biggest country when it comes to the usage of Bitcoin and cryptocurrencies.

“Governments and businesses all over the world are realizing the powerful potential usability of blockchain. … Nigeria, however, is lagging due to the government institutions’ sore-footedness and refractory approach to this undeniably ingenious innovation.” Hannah Akuiyibo is an Associate at the Woodrow Wilson International Center for Scholars in Washington, D.C

According to a recent study seen by Nairametrics, data retrieved from Usefultulips (a Bitcoin analytic data provider) revealed that the use of Bitcoin for peer-to-peer lending in Nigeria surged by 16% since the CBN directive took effect.

Such actions are creating a much higher demand for Bitcoin by a growing number of Nigerians. And this has led the unofficial crypto market popularly known as the black crypto market to thrive. The more challenging and disruptive development is that as a recent study by Nairametrics reveals, Nigerians are made to cough a hefty premium on Bitcoin, as the leading world cryptocurrency has gone for as high as about $75,000 a premium of 36% through these dark channels.

Positive examples of dealing with cryptocurrencies by governments

130 countries in the world as well as most regional organizations have issued laws or policies on the subject. The past four years in particular have seen cryptocurrencies grow fast and become ubiquitous, prompting more national and regional authorities to grapple with their regulation.

The expansive growth of digital assets and cryptocurrencies makes it possible to identify emerging patterns.

The Singapore government and the Monetary Authority of Singapore (MAS) is a great example of a country that has actively encouraged the growth of the FinTech and cryptocurrencies innovation in their industry to entrench Singapore as a global financial hub. The Singapore government has further its initiative to transform Singapore into a ‘Smart City’ digital innovative and regulatory wise platform for financial innovation and cryptocurrencies.

The city-state of Singapore has been treating cryptocurrencies wisely from a positive angle and doesn’t ignore their potentiality. This has been done by working in sandboxes that comprehend major players, entrepreneurs, banks and its financial regulators. In fact Singapore was among the first in 2020 to issue relevant laws within the global framework under which the country’s crypto businesses operate.

In January 2021, the Monetary Authority of Singapore, the nation’s central bank, issued the Payment Services Act, regulating the circulation of cryptocurrencies and the activities of related companies, which must comply with Anti-Money Laundering and Combating the Financing of Terrorism rules.

Crypto companies are welcome in Singapore but they must first register and apply for a license to operate in the city-state. To clarify the system on how to get a license, the Association of Cryptocurrency Enterprises and Startups Singapore has introduced a “Code of Practice” to assist companies in their applications.

Another example of a positive relationship with crypto currencies is the case of South Korea.

South Korea also has a clean-cut vision of cryptocurrencies; however, it approaches the regulation of digital assets in a very tough manner, viewing digital assets as legal tender. Its local exchanges are tightly controlled by government agencies, including the Financial Services Commission. In addition, the country’s Ministry of Economy and Finance can conduct comprehensive checks of Bitcoin exchanges. Since September 2017, ICOs and margin trading have been banned.

The South Korean government has since passed a bill to regulate cryptocurrency exchanges in the country. The National Assembly adopted a revised bill on reporting and conducting certain types of financial transactions, including crypto. The government has until March 2021 to implement the law. Once in effect, blockchain startups will be given a six-month grace period to bring their activities in line with the new rules.

This bill will affect crypto exchanges, funds and crypto wallets in South Korea. In the country companies conducting ICOs; and other market participants. They will be required to comply with all financial reporting requirements, use only bank accounts with real names, conduct user identification such as Know Your Customer, and certify their information security management systems. In July, the government suggested introducing a tax on income from crypto trading and even set a rate of 20%, but so far, the law has not been adopted.

As for the use of Cryptocurrencies, DeFi and blockchain grows in the global adoption investors, private business, government have to collaborate more than ban or getting in fear. This collaboration will mitigate risks and special will create awareness for ussies and scams and will focus on highlighting the advantages and possibilities of the crypto currencies and will contributes to the development of this 360 sector that affects all society at large and that governments, financial institutions and central banks can not afford to ignore or worst left out.

Sources and related links:

Regulation of Cryptocurrency Around the World

BCG | How Banks Can Succeed with Cryptocurrency

https://on.bcg.com/3k1xA5M via @BCG

Why Crypto black market is thriving in Nigeria

https://nairametrics.com/2021/02/22/why-crypto-black-market-is-thriving-in-nigeria/

What happens when governments get into cryptocurrency

https://mashable.com/2018/01/08/cryptocurrency-bitcoin-governments/?europe=true

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.