Blockchain The Shift Inception of a Database of Everything

In a time of Artificial intelligence and Internet of Everything, Blockchain is now becoming the shift inception database of the internet, the new macro database and maybe as it is scaled, the new holistic global source database for everything that is related with value creation, (big) data, and identity!

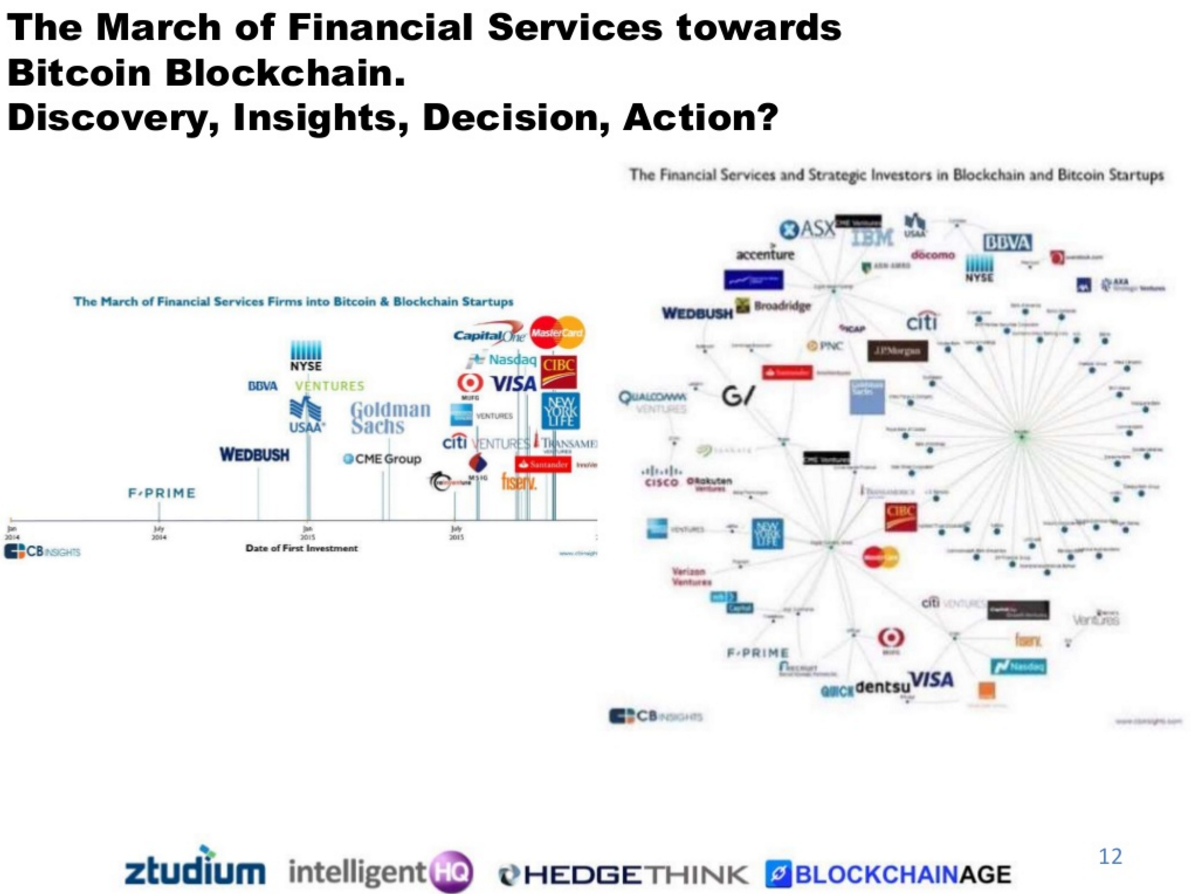

Is the Blockchain the real deal, the seminal “trust protocol”? As Blockchain-related interest and investment reaches critical mass, most of the top-tier global banks start adopting it, and the technology shows itself to be capable of driving major change. Leaders worldwide are starting to investigate it in detail and looking at real life scale solutions.

Blockchain enforces the convergence on common data standards, and eliminates, in theory, the need for a central authority to hold some kind of moving assets, ie, a value exchange through some kind of “golden record”, Blockchain holds the potential of reducing reconciliation and facilitate a seamless transfer of digital assets.

How to make an effective clearing up of the common myths and how to demonstrate how this technology has the potential to reshape global governments infrastructural technologies, financial markets and ultimately all kinds of companies?

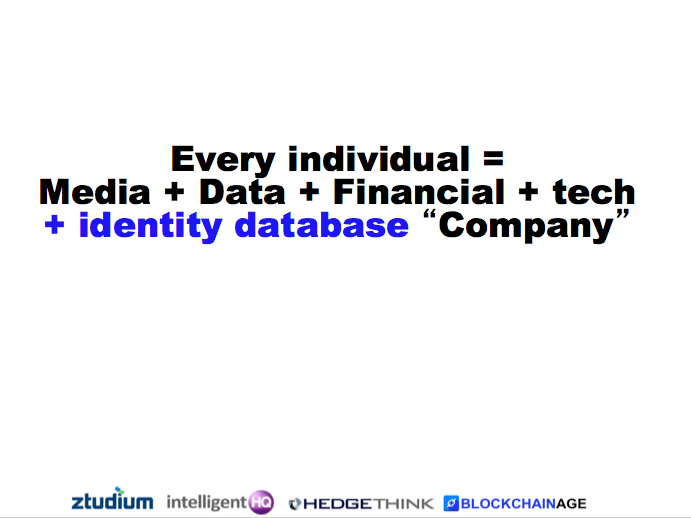

Let us start with some basic concepts, not about blockchain, but about each one of us:

In a global increasing local / national world of IOE and AI how are we going to manage our individual centralised / decentralised self and apply that to our daily use of media, data, financial and tech identity? One first step is to become deeply aware that we are media, data, tech platforms, while using our phones, computers, apps.

We are in a process of digitalisation of everything, from our use of data to our DNA, and in the future, our integration of DNA and objects around us.

This happens to each of our individual self, and paradoxically it happens also to companies, businesses, and financial organisations that manage our data:

Media + Data + Financial + Innovation + tech

+ identity database Company! Dinis Guarda

So in this context, there is one critical question:

In global increasing local / national world of IOE, AI how are we going to manage centralised / decentralised blockchain tech?

Blockchain had its inception with machine automation of data and after the advent of bitcoin became a trusted proof of concept ledger solution to facilitate our increasingly complex interactions through digital technologies. Will we have a “Trusted New Central Bank of Everything Computing?”

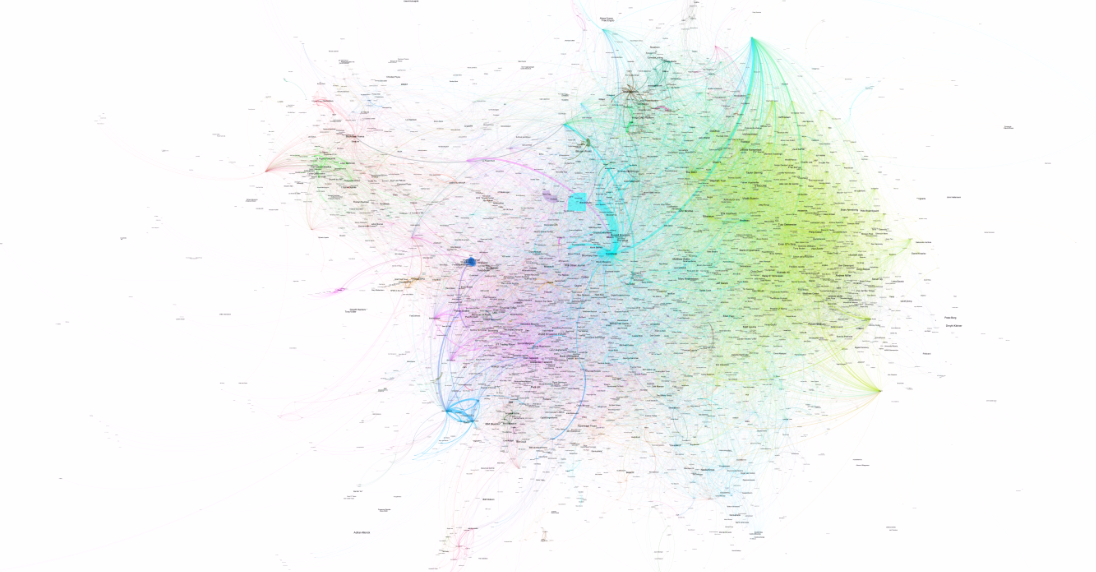

When one aggregates and combines the full-length concepts behind the blockchain: the decentralised database, the starfish holistic consensus, the inception of smart contracts, the advent of new virtual identity, new payment ecosystem, one starts to realise how Blockchain is enabling the spread of technology, not just Fintech, but broader resources and transactions, literally in a flat, peer-to-peer ecosystem, and in doing that, enabling computers and its data to trust one another on a deep global level.

In some ways, blockchain is part of an evolution of tech that tries to create a trusted New Central Bank of Everything Computing. When one aggregates and combines the full-length concepts behind the blockchain. When we are talking about a decentralised database, the starfish holistic consensus, that uses a DNA of direct smart contracts, and aligns digital ecosystems towards the advent of new virtual identity, new payment solutions.one starts to realise Blockchain is enabling the spread of technology, not just Fintech, but broader resources and transactions, literally in a flat, peer-to-peer ecosystem, and in doing that, it is enabling computers and its (almost all available) data to trust one another on a deep global level.

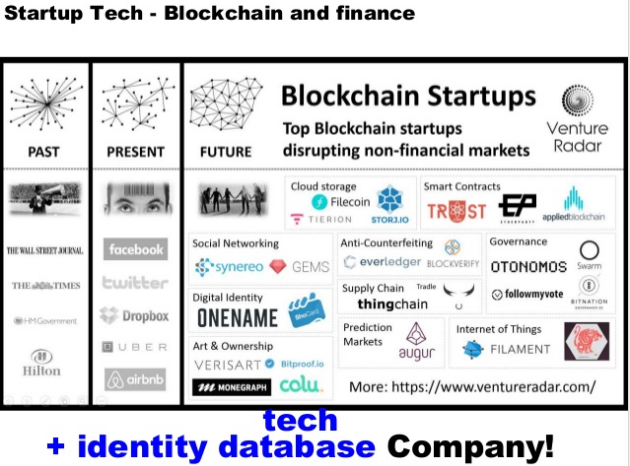

Understanding Blockchain requires an understanding of the global tech and financial Ecosystem.

As it has been widely debated, the information asymmetry has dominated the financial and banking industry for centuries, keeping the bank/investor liability neatly aligned. This paradigm is changing, and understanding and preparing for the repercussions must be a top priority for industries everywhere.

9 Trends for Finance / Blockchain Industry?

1. Redefinition of banking and relation with Blockchain

2. Mobile App banking finance – mobile ledgers – blockchain identity

3. New products and the emergence of DAO products.

4. System Legacies in parallel with advanced tech – Ethereum.

5. Distribution Strategy in a new Digitalised World who own what.

6. Super-computer Cloud baseblockchainn solutions / infrastructure.

7. The emergence of AI IOE in relation with blockchain all connected.

8. User Experience, UI, UE, Big data and the IOE blockchain touching.

9. Blockchain Cyber Security and Value Reinvention.

Blockchain, in its ideal incarnation, promises to revolutionise the way we transfer and store our most valuable assets. It has the power to transform financial services and the speed and security with which we conduct transactions, as well as simplifying legal processes (via self-executing smart contracts), enhancing healthcare records and tightening national security.

New research from specialist outsourced services provider SEI suggests that 70 percent of decision makers in wealth management firms have not allocated specific resources to considering blockchain and the impact it could have on their business.

Global lenders including Citigroup, UBS, Barclays and Santander, are now experimenting with the technology to see how it can reduce costs and mitigate the risks of their own transactions. “Blockchain is an intimidating topic and there’s a lot to manage between the promises and the delivery. It promises a profound transformation in work flows, reduction of capital risks, greater security and, ultimately, it could lead to many cost efficiencies for wealth management” says Susan Ramonat, blockchain program lead and chief risk operator at SEI. Blockchain and Wealth Management.

Companies, digital and mobile set of applications are using or testing Blockchain tech that aggregates all of the mentioned, but in centralised or decentralised extract business with specific intelligence and very important with actionable insights that can be scalled.

Peer to peer finance, IOE blockchain driven organisations are going to be more powerful than ever. But of course will be facing a few challenges:

- Global regulation and local governments;

- Retail Vs. Institutional blockchain media driven communities;

- Open versus closed blockchain;

- Who will control all data – governments, corporations, identitities, non governmental organisations;

- The advent of blockchain digital identity ledgers – digital currencies and global decentralised organisation;

- Big data / Social Media / Blockchain tech hacking driven disruption, platforms and social – creating social identity / financial disruption:

To finish this insights and thoughts on the way Blockchain is advancing as a shift inception fo a macro database for everything I want to highlight the following:

6 Questions and Trends for Blockchain

- The increase of identity blockchain mobile and App UX / UI platforms.

- How to adapt Blockchain on the local, regional, national context and technologies;

- Technical digital semantic platforms based on interest sentiment and algorithms for investors and traders based in blockchain tech;

- The way we share value based on blockchain integration with (big) data and offshore, open government regulations;

- The way open data and innovation are transforming countries, emergent markets, laws and business strategies;

- The idea of blockchain thought leadership groups supporting each other and creating premium digital databases organisations, cities.

Reading List About Blockchain:

Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business and the World

Blockchain: Blueprint for a New Economy

The Business Blockchain: Promise, Practice, and Application of the Next Internet Technology

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.