Looking for a secure way to grow your Bitcoin without selling? The Xapo Bank app combines licensed banking with crypto innovation, offering Bitcoin-backed loans, 3.5% APR on USD, and a premium debit card with up to 1% BTC cashback. Read on to find out if Xapo Bank is the ultimate wealth solution for crypto holders.

For cryptocurrency holders, particularly Bitcoin enthusiasts, keeping their assets secure while having access to liquidity can often be a challenge. The traditional solution, selling the asset, may not always be appealing, especially when you want to hold on to your Bitcoin for long-term growth. This is where Xapo Bank steps in, offering a platform where you can unlock cash without parting with your valuable Bitcoin.

What is Xapo Bank?

The Xapo Bank app combines a fully licensed private bank (Xapo Bank) with a regulated Virtual Asset Service Provider (Xapo VASP), both authorised by the Gibraltar Financial Services Commission (GFSC). Founded with a mission to merge Bitcoin with traditional banking, Xapo provides high-net-worth individuals and crypto-savvy users with a secure way to grow and protect their wealth.

Unlike typical crypto lending platforms, the Xapo Bank app offers bank-grade security, daily annual interest earnings in Bitcoin, and a premium debit card with unlimited cashback, all while keeping assets fully protected.

How Xapo Bank Works

The Xapo Bank app allows members to seamlessly manage both Bitcoin and traditional currencies like USD. Its services are designed to meet the needs of individuals who want to grow and protect their wealth, whether in crypto or fiat.

One of the most attractive features is the Bitcoin-backed loans. Members can unlock cash without selling their Bitcoin, using it as collateral. The loan approval is based on the amount of Bitcoin held, and borrowers can receive instant cash, which can be spent or transferred globally. Xapo also offers high-interest savings accounts, USD deposits earn 3.5% APR, while Bitcoin savings offer up to 0.5% APR on your first 2 BTC, both paid daily in BTC.

The Xapo Bank debit card is another key feature, enabling users to spend globally in both USD and Bitcoin, with no foreign exchange fees and up to 1% cashback on every transaction, paid in Bitcoin. Xapo Bank’s platform ensures a smooth and secure experience, allowing users to move funds effortlessly, whether in fiat or cryptocurrency.

Premium Membership Fee

The premium membership at Xapo Bank costs $1,000 annually. While this fee is relatively high, it includes numerous benefits such as the ability to manage Bitcoin holdings securely, take out Bitcoin-backed loans, trade Bitcoin with low fees, and enjoy a host of other features. For those seeking to grow their wealth with Bitcoin and benefit from global spending and savings, the cost may be justified.

Who Is Xapo Bank For?

Xapo Bank is tailored for a specific group of users, making it an ideal choice for:

- High-Net-Worth Individuals with Bitcoin Holdings: Those holding significant Bitcoin assets can benefit from Xapo Bank’s wealth management and security features.

- People Seeking Easy Money Transfers: Xapo Bank offers effortless global money transfers, ideal for individuals frequently transferring assets across borders.

- Wealth Builders and Bitcoin Enthusiasts: Those looking to grow their wealth, particularly in Bitcoin, will find the savings and interest-bearing accounts attractive.

- Individuals Needing Liquidity Without Selling Their BTC: Xapo Bank’s Bitcoin-backed loans allow customers to access cash without the need to sell their Bitcoin, maintaining exposure to the market.

How to open an account at Xapo Bank

Opening an account with Xapo Bank is a straightforward process. Members can sign up directly through the Xapo Bank app and quickly start managing their Bitcoin and USD assets. Unlike traditional banks, Xapo does not require extensive paperwork or personal financial disclosures.

All that is needed is a phone number and a crypto address. Once the account is set up, users can start enjoying the platform’s features, such as earning interest on their savings or applying for a Bitcoin-backed loan.

Is It Safe to Use Xapo Bank?

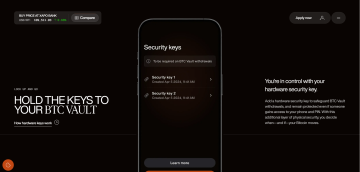

Xapo Bank takes the security of its users’ assets very seriously. It employs a comprehensive security system, which includes cold wallet storage for Bitcoin holdings, ensuring that your funds are safe from potential online threats. The platform also offers two-factor authentication (2FA), adding an extra layer of protection for users.

Xapo Bank’s reputation is built on trust, and it is regulated by the Gibraltar Financial Services Commission, which adds a layer of credibility and transparency to its operations.

Additionally, users can rest assured knowing that their Bitcoin collateral remains secure and untapped in Xapo’s vaults, never being lent out or rehypothecated.

Bitcoin-Backed Loans: Flexibility and Liquidity

Xapo Bank provides a unique service with its Bitcoin-backed loans. Users can borrow up to $1 million USD with loan-to-value (LTV) ratios between 20% and 40%. These loans come with competitive interest rates starting around 10% per year, and they offer flexible repayment terms of 1 to 12 months, with no hidden fees or early repayment penalties.

Key Features of Bitcoin-Backed Loans:

- Instant cash: Borrow up to $1 million USD with the option to instantly receive funds in your Xapo account.

- No hidden fees: There are no hidden fees or penalties for early repayment.

- Secure custody: The Bitcoin used as collateral remains safely locked in Xapo’s secure vault, with no rehypothecation or lending out of collateral.

- Competitive rates: Interest rates start at approximately 10% annually, making this an attractive option for Bitcoin holders who want liquidity without selling.

- Flexible repayment options: Users can repay their loans anytime without incurring penalties, and even use Bitcoin collateral for repayment if desired.

Xapo Bank Debit Card: Global Spending with Added Perks

One of Xapo Bank’s most compelling features is its global debit card, which provides the ability to spend in both Bitcoin and USD. This card offers significant advantages, including unlimited cashback and no foreign exchange fees, making it a versatile option for users who want to spend their crypto and fiat funds alike.

Key Features of the Xapo Bank Debit Card:

- Global usage: The Xapo debit card is accepted worldwide, enabling seamless purchases and ATM withdrawals.

- Up to 1% cashback in Bitcoin: Users earn up to 1% cashback on every purchase, with rewards paid in Bitcoin.

- No foreign exchange fees: Spend in USD and BTC without worrying about hidden currency conversion fees.

- Free ATM withdrawals: The first $100 per month is free, with a small 2% fee thereafter.

- High spending limits: Xapo offers high spending limits on the card, enabling users to make significant purchases, such as buying a car.

Why choose Xapo Bank?

Xapo Bank offers a range of features that are ideal for cryptocurrency holders who are looking to grow their wealth without giving up their Bitcoin assets. Some reasons to consider Xapo Bank include:

- Security for crypto assets: Xapo Bank employs robust security protocols to ensure the safety of user assets, including cold storage for Bitcoin holdings.

- Up to 1% cashback in BTC: Xapo Bank’s debit card provides up to 1% cashback on every transaction, with rewards paid directly in Bitcoin.

- Bitcoin-backed loans: Access to cash without needing to sell Bitcoin, with competitive interest rates and no hidden fees.

- Global debit card usage: The Xapo debit card allows global spending, with no foreign exchange fees and high spending limits.

- Competitive savings rates: Earn up to 3.5% APR on USD deposits and 0.5% APR on your first 2 BTC, both paid daily in Bitcoin.

How to contact Xapo Bank support

Xapo Bank offers 24/7 customer support to assist with any questions or issues you may have. You can reach the support team directly through the in-app messaging feature, or via email at https://customersupport.xapo.com/. The customer service team is known for providing quick responses and resolving issues efficiently.

Is Xapo Bank right for you?

The Xapo Bank app combines the best of traditional banking with the innovation of cryptocurrency services. Its licensed status, robust security system, and unique offerings, such as Bitcoin-backed loans and a high-reward debit card, set it apart in the world of digital banking. However, the $1,000 annual subscription fee may deter some potential customers, especially those who do not regularly use Bitcoin or require premium services.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.