Thinking about buying your first rental property in 2025? A lot of people are looking for ways to build wealth, earn passive income, or just make smarter moves with their money — and rental properties are often the first place they look.

But before you jump in, there’s a lot you need to know. The housing market’s changed, interest rates are different, and what worked a few years ago might not work now. That doesn’t mean it’s a bad idea — it just means you need to be better prepared.

This guide is here to help you what beginner investors should know before buying rental property.

Understand the 2025 Housing Market Landscape

Before buying a rental property in 2025, you need a good feel for what’s happening in the housing market right now. Things aren’t the same as they were a few years ago, and the way people live, rent, and buy homes is changing fast.

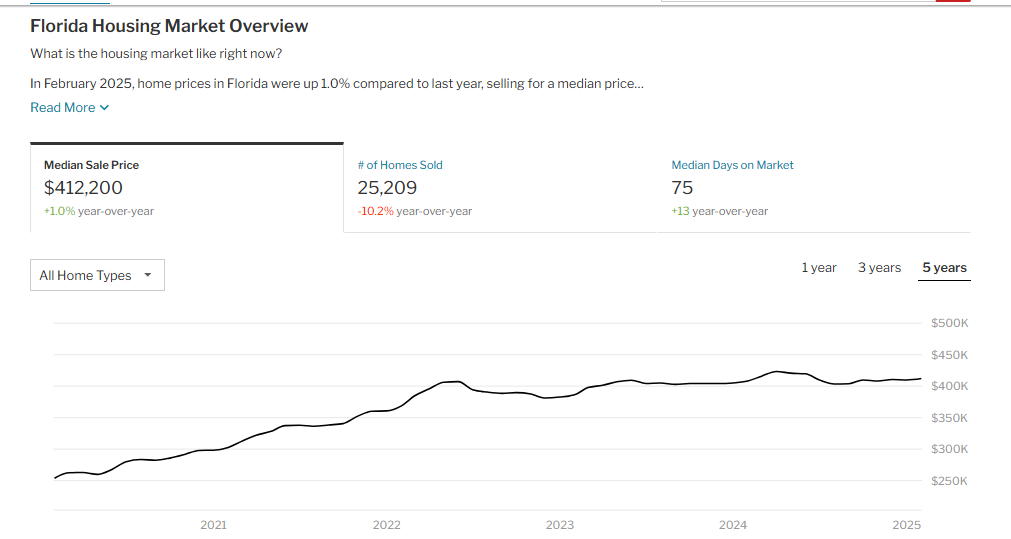

Home prices are still high in many areas, but growth has slowed down. For example, in Florida, the median home sale price in February 2025 was $412,200, which is just 1.0% higher than last year. That’s a big change from the rapid growth seen between 2020 and 2022, when prices shot up fast.

Now, the market is more stable. While it’s still expensive, prices aren’t climbing as quickly — giving investors a better shot at buying without chasing inflated numbers.

Interest rates are another big factor. They’ve been higher than what many investors are used to. That means monthly payments on loans will cost more. But don’t let that scare you off — many investors are still buying, they’re just being more careful with the numbers.

Martin Seeley, CEO & Senior Sleep Expert at Mattress Next Day, shares, “Rental demand is strong, especially in areas where people are moving for jobs or lower living costs. More folks are renting long-term because buying a home is harder now. That’s a win for rental property owners.”

Some key markets to keep an eye on in 2025 include places like Texas, Florida, and parts of the Southeast — what people call the “Sun Belt.” These areas are growing fast thanks to job growth, lower taxes, and a warm climate. Suburbs around big cities are also in high demand, especially with remote work still being common.

On the economic side, we’re seeing wage growth slowly rising, and inflation is easing a bit, but it’s still something to watch. Remote work continues to shape where people want to live.

According to Martin Heaton, Director of Heaton Manufacturing, “Many renters are choosing lifestyle over location now — which means more opportunity if you pick the right market.”

Know Your Investment Goals

Before you buy a rental property, stop and ask yourself — What do I actually want from this? Your goals will shape every decision you make.

Some people want monthly passive income — a steady cash flow from rent that covers the mortgage, expenses, and puts extra money in their pocket. Others are in it for long-term equity, meaning they’re okay with just breaking even now because they’re betting the property will grow in value over time.

“Smart investors know there’s no one-size-fits-all approach — it’s about aligning your strategy with your goals, whether that’s cash flow today or appreciation tomorrow,” says Clive Gray, from London Review of Suit Tailors.

Neither goal is wrong — it just depends on what matters more to you.

You’ll also need to decide between a cash flow strategy (buying in affordable areas with strong rental demand) or hoping for appreciation (buying in up-and-coming areas that might grow in value later). Ideally, a great deal gives you both, but that’s rare. Most beginner investors have to pick one and build from there.

And finally — how involved do you want to be? If you’re ready to handle things yourself (repairs, tenants, late-night calls), that can save money. But if you’re busy or just not interested in being a landlord, hiring a property manager might be worth it — even if it eats into your profits a bit.

Get clear on your goal early. It’ll save you a ton of confusion and bad decisions later.

Get Your Finances in Order

To be honest, buying a rental isn’t cheap. Even if the numbers work out, lenders and sellers want to see that your finances are in good shape.

First, most lenders ask for a 20% to 25% down payment on investment properties. Unlike a regular home loan, there’s no skipping the big upfront cost unless you’re house hacking or getting creative.

Next, your credit score matters. A score of at least 680 will give you more loan options, but higher is better.

Lenders also look at your Debt-to-Income (DTI) ratio, which shows how much debt you have compared to your income. Keep it low to get better rates.

Also, don’t forget the money you’ll need after you buy. You should have an emergency fund — ideally 3–6 months of expenses — and some extra cash for repairs, vacancies, or unexpected issues. Even a small leak can cost thousands if you’re not ready.

“Buying the property is just the beginning — the real test is how well you manage the unexpected costs that come after,” says Eric Andrews, Owner of Mold Inspection & Testing.

Master the Math

You don’t need to be a math genius to buy a rental property — but you do need to understand a few simple numbers. These will help you figure out whether a deal actually works or if it’s going to drain your savings. Too many first-time investors skip this part and end up with properties that barely break even or lose money. Don’t be that person.

Start with cash flow. That’s the money you have left each month after paying all the property expenses — things like your mortgage, taxes, insurance, and maintenance.

Eli Pasternak, Founder & CEO of Liberty House Buying Group, mentions, “Cash flow is what keeps your investment alive month to month — ignore it, and you’re just hoping the numbers work out.”

For example, if you’re bringing in $2,000 in rent and your monthly expenses total $1,600, your cash flow is $400. If that number is positive, great. If it’s negative, it means you’re losing money each month unless you’re banking on the property going up in value later.

Next is cap rate, short for capitalization rate. It’s a way to compare how profitable one property is compared to another. You calculate it by dividing your net operating income by the purchase price, then multiplying by 100.

So if you’re making $10,000 a year on a $200,000 property, your cap rate is 5%. In 2025, most investors aim for a cap rate between 5% and 7%, depending on the location.

Then there’s cash-on-cash return, which tells you how much money you’re earning based on the cash you actually put into the deal — not the full property price. If you invested $50,000 and earned $5,000 in annual cash flow, your return is 10%. This number helps you compare deals, especially if you’re choosing between properties with different down payments.

Bryan Dornan, Mortgage Lending Expert & Founder at Second Mortgage Rates, says, “The classic 1% Rule is still useful. The idea is that the monthly rent should be about 1% of the purchase price. So if a home costs $200,000, you want it to rent for at least $2,000 per month. It’s not always possible in expensive markets, but it’s a great quick check to see if a deal is worth a deeper look.”

Understand Local Laws and Regulations

Owning rental property isn’t just about finding a good deal—you also need to follow the rules. And in 2025, those rules are changing fast.

Some areas now have rent control zones, which limit how much you can raise the rent each year. It’s meant to protect tenants, but it can also shrink your profits if you’re not prepared. New York, California, and Oregon have some of the strictest controls.

Zoning laws are also shifting. Cities are updating regulations to allow more multi-family housing or prevent short-term rentals. If you plan to Airbnb or add a second unit, always double-check what’s legal in that area.

You’ll also need to understand landlord-tenant laws. Noam Friedman, CMO of Tradeit, notes, “Every state has its own rules for things like security deposits, notice periods, and evictions. Some places now require longer notice before raising rent or stricter reasons to evict a tenant. And if you mess that up, it can cost you a lot.”

In some cities, landlords must register their rental property or get a license before renting it out. This can involve inspections, fees, and paperwork. It’s not fun, but skipping it could lead to fines or legal trouble.

Before you buy, take time to understand the local laws. A great deal can turn into a headache if you land in a spot with heavy restrictions you didn’t see coming.

Related Contents:

What Is the Best Reason for Why Someone Would Want to Lease a House Instead of Buy One?

The ultimate way to sell a home instantly

Property Management Decisions

Once you buy a rental property, someone has to take care of it — and that someone might be you. One of the first choices you’ll make as a landlord is whether to manage the property yourself or hire a property manager to handle it for you.

If you self-manage, you’re responsible for everything. That means finding and screening tenants, collecting rent, handling maintenance requests, responding to complaints, and dealing with late payments or evictions, adds Mark Mechelse, VP of Marketing at Master Magnetics. It can save you money, but it also takes time, patience, and some problem-solving skills — especially if you’re managing from a distance.

On the other hand, hiring a property manager means you can be more hands-off. In 2025, most property managers will charge around 8% to 12% of the monthly rent, plus additional fees for leasing or repairs. For some investors, it’s worth every penny — especially if they have a full-time job, multiple properties, or just don’t want the stress.

That said, even with a manager, you’re still the owner. You’ll need to approve big repairs, keep track of your finances, make sure your property stays up to code, and check in regularly to avoid bigger issues down the line. Whether you manage it yourself or not, staying involved is part of being a smart investor.

Common Mistakes Beginner Investors Should Avoid

Every new investor makes mistakes — but the smart ones learn before they make them. One of the biggest is underestimating expenses. New landlords often forget to budget for things like repairs, vacancies, property taxes, or rising insurance costs.

Jake Smith, Founder of DVLA Number Plates, “Always assume things will cost more than you think. And plan for it.”

Another common mistake is overleveraging — borrowing too much without enough cash to cover emergencies. Just because a bank approves you doesn’t mean it’s a safe investment. Keep some breathing room in your finances.

Some beginners also focus too much on appreciation and ignore cash flow. A property might go up in value over time, but if it’s losing money every month, it could put you in a tight spot fast. In most cases, especially early on, it’s smarter to buy properties that put money in your pocket right away.

Start Small, Then Scale

When you’re new to real estate investing, it’s easy to feel like you need to go big right away.

Siebren Kamphorst, COO of Rently, highlights, “You see people on social media buying apartment buildings or flipping five houses at once, and it can make your single rental property feel small. But starting small is one of the smartest things you can do.”

Your first deal is where you learn the most. You’ll figure out how to run the numbers, deal with tenants, handle repairs, and manage your emotions when something doesn’t go as planned. That’s a lot easier to do when you’re only dealing with one property — not five.

Buying something simple, like a single-family home or a small duplex, helps you learn without taking on too much risk. It keeps things manageable. You can pay more attention to the details, get to know the process, and build confidence as you go. Plus, lenders are usually more willing to finance smaller deals when you’re just starting out.

Once you’ve gone through the full cycle—buying, renting, managing, and maybe even refinancing — you’ll be in a much better position to grow. You’ll know what works, what doesn’t, and what kind of properties suit your style. That’s when scaling up becomes not just possible, but sustainable.

Beni Avni, Owner of New York Gates, shares, “Some of the most successful investors today started with just one rental. They stayed consistent, reinvested their profits, and slowly grew their portfolio over time.”

So don’t feel pressured to go big on your first try. Focus on learning, getting it right, and building a strong foundation. The rest will come.

Wrap Up

Getting into rental property investing in 2025 is a smart move — but only if you take the time to learn the basics first. Don’t rush. Focus on understanding the market, setting clear goals, running the numbers, and knowing the laws. Start small, stay realistic, and plan for both the ups and downs.

Real estate is a long game. But with the right mindset, a bit of patience, and a willingness to learn as you go, it can turn into something really solid. Do your homework, trust the numbers, and take your first step with confidence.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems