What is slippage?

When trading forex, slippage occurs when the price at which you request your order to be executed is different than the price at which your broker executes the trade. Slippage does not necessarily mean a positive or negative price movement; it merely implies that the requested price is different from the execution price. Note that slippage can significantly increase the CFD charges due to the increase in the spread. You can practice on demo accounts to be familiar with the CFD trading charges that you might incur.

Causes of slippage

- Higher market volatility. Increased volatility causes the prices to change too quickly from when a position is opened to when it is executed.

- The efficiency of trade executions. When the broker is slow at executing trades, the market price will have changed from when you opened the position to when it is executed.

- Market gaps.

What is the gap in the forex market?

In the forex market, the gap is a disconnect in the price of a currency pair – up or down. There is no trading activity occurring in this period of a price disconnect. If you were to chart the price of a currency pair using candlesticks, for example, a gap could be seen where there is a discontinuity between the close of the previous candle and the opening of the next candle.

Causes of Gaps in Forex

Causes of Gaps in Forex

There are two major causes of gaps in the forex market. They are the release of unexpected economic data and the continuation of trading after the weekend. You can test their trading either on a free forex demo account or via a forex no deposit bonus. Both options are safe as you don’t risk your own hard-made money.

Release of Unexpected Economic Data

It is common knowledge that the release of fundamental economic indicators impacts the forex price action. On any economic calendar, such as the one on CAPEX.com, the schedule of the release of fundamental indicators is indicated. Also, the previous reading and the analysts’ prediction of what the next reading will be. Now, imagine a scenario where the actual data is much greater or much lower than the expected data. In this case, the market can be overly volatile.

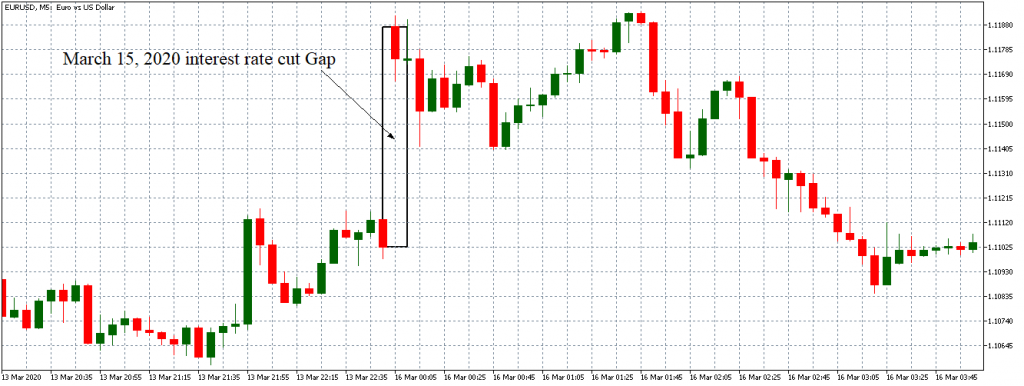

Similarly, whenever there are any major geopolitical events or a release of significant data over the weekend or a public holiday, once the market resumes trading, there might be a gap.

Take an example of when the US Federal Reserve announced surprise interest rate cuts on Sunday, March 15 2020, at 5.00 PM ET. The interest rates were cut from 1.25% to 0.25%. When trading resumed on Monday, March 16, 2020, at 7.00 AM AEST, the EUR/USD had a gap.

Resumption of Trading after the weekend

Resumption of Trading after the weekend

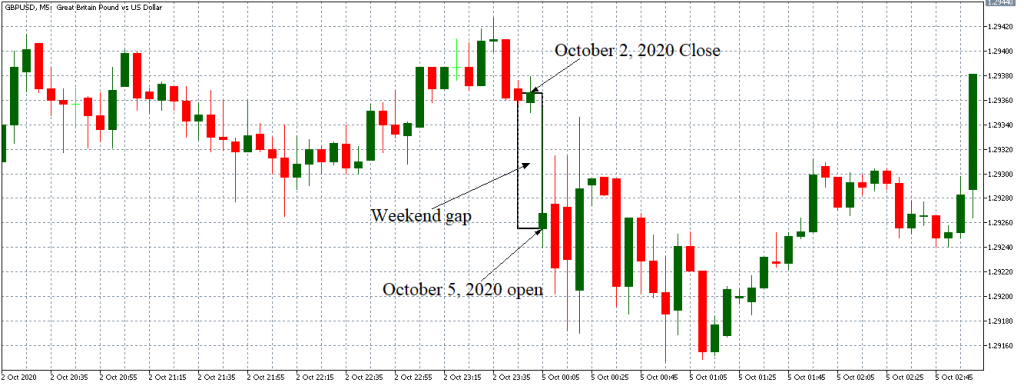

For retail traders, the forex market is open 24/5 from Monday 7.00 AM AEST to Friday 5.00 PM EST. However, the interbank forex market operates 24/7. Therefore, when retail traders cease trading on Friday 5.00 PM EST, forex trading in the interbank market continues. This continuation of trading means that the prices of currency pairs will keep fluctuating over the weekend. When the market opens on Monday at 7.00 AM AEST, it is expected that the opening price for a currency pair will be different from the closing price on Friday 5.00 PM EST.

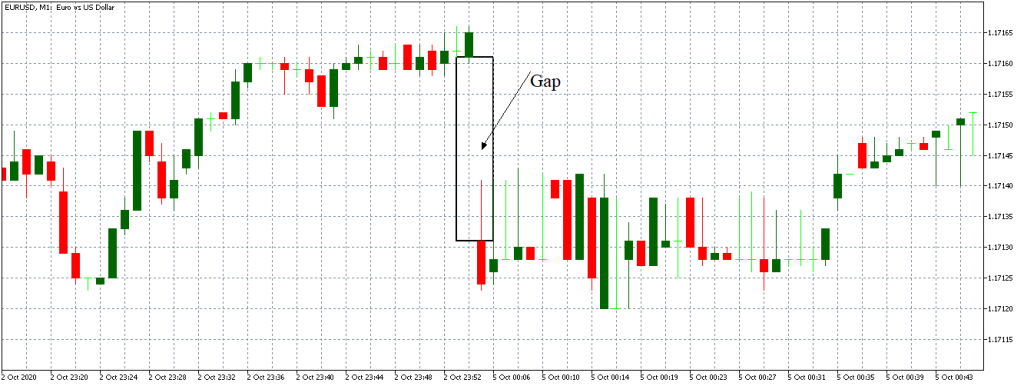

Here’s one example of the GBP/USD pair gap from the closing on Friday, October 2, 2020, 5.00 PM EST and the opening on Monday, October 5, 2020, 7.00 AM AEST.

Types of Gaps in Forex

Types of Gaps in Forex

There are four main types of gaps in forex. They are the breakaway gap, the runaway gap, the exhaustion gap, and the common gap.

The common gap

These gaps are the most frequently occurring gaps in the forex market. They are a result of the regular trading routine for a currency pair and are not caused by any external forces or events. The opening gap after a weekend is the best example of a common gap in the forex market.

In some cases, it is expected for the common gap to be closed by the intraday price fluctuation. Let’s look at how the gap on the weekend after October 2, 2020, filled up.

In this example of a 5-minute GBP/USD chart, the common gap was closed after 3 hours of the market open.

In this example of a 5-minute GBP/USD chart, the common gap was closed after 3 hours of the market open.

The breakaway gap

This gap occurs when the price breaks past a support or resistance level. These support and resistance levels can be established if a currency pair has been trading within a particular range. Thus, when a currency pair breaks out of a trading range and forms a new trend, it is a breakaway gap.

Other than establishing new trends as is the case when breaking out of a trading range, breakaway gaps can also be used to confirm a trend. For example, if a pair is on a downtrend, shows signs of a reversal to an uptrend and is accompanied by an upward breakaway gap, it can show strong signs of the uptrend continuing.

Other than establishing new trends as is the case when breaking out of a trading range, breakaway gaps can also be used to confirm a trend. For example, if a pair is on a downtrend, shows signs of a reversal to an uptrend and is accompanied by an upward breakaway gap, it can show strong signs of the uptrend continuing.

The exhaustion gaps

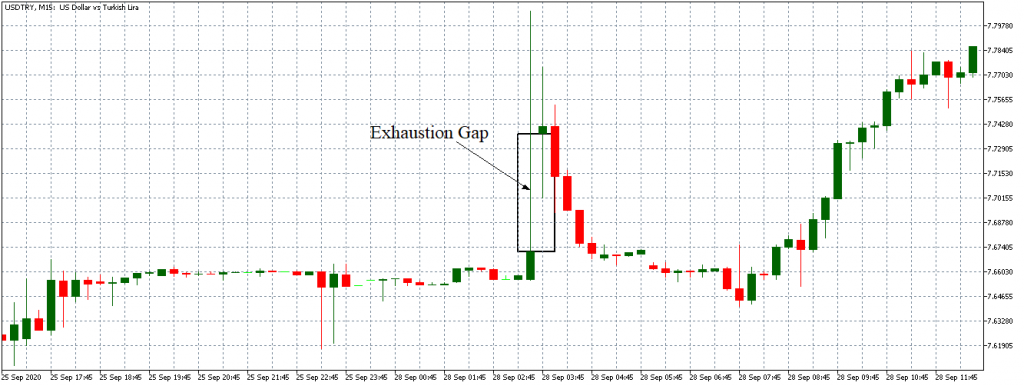

As the name suggests, these gaps occur when a particular trend is weakening and nearing its end. This gap forms after a persistent price action in one direction. When a currency pair has been on a long bullish trend, the exhaustion gap is a small upward price gap at the peak of the trend and is followed by a trend reversal. The exhaustion gap in a bullish market trend is seen as a final surge in buyers before the prices drop.

Similarly, when a pair has been on a constant downtrend, the exhaustion gap is a small downward price gap near the bottom of the downtrend. An upward trend follows this gap. The exhaustion gap at the end of a bearish trend represents a surge in the number of sellers before the prices rise.

Similarly, when a pair has been on a constant downtrend, the exhaustion gap is a small downward price gap near the bottom of the downtrend. An upward trend follows this gap. The exhaustion gap at the end of a bearish trend represents a surge in the number of sellers before the prices rise.

Note that the exhaustion gap can only be identified once the trend reversal has started to form.

The runaway gap

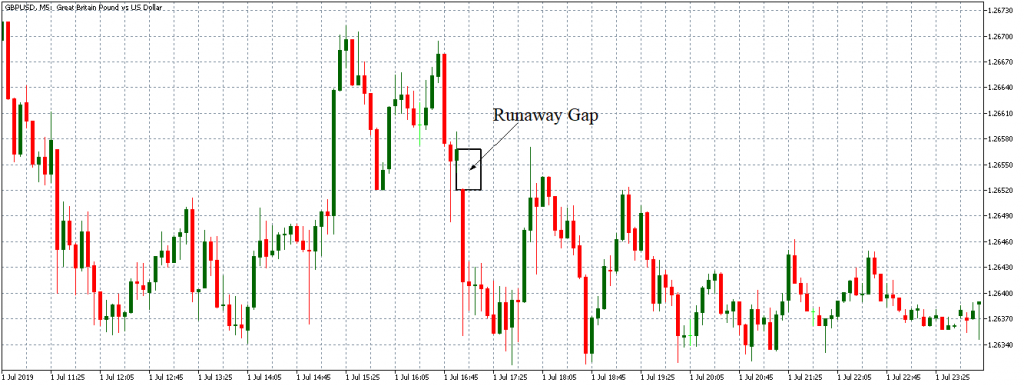

This gap forms within a continuing trend. It signifies the intensity of investors as that particular trend continues. As the name suggests, the price, in this case, runs away within the trend. For example, in an upward trend, the runaway gap will be in the form of an upward gap as traders become more bullish.

In a bearish trend, the runaway gap will be in the form of a downward gap which signifies an increased selling activity by the traders. Thus, the runaway gap can be used to confirm the continuation of a particular trend.

We hope you found this article informative. It is crucial to understand this concept of Gaps and Slippage to avoid typical trading mistakes.

We hope you found this article informative. It is crucial to understand this concept of Gaps and Slippage to avoid typical trading mistakes.

This is an article provided by our partners’ network. It does not reflect the views or opinions of our editorial team and management.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems

Causes of Gaps in Forex

Causes of Gaps in Forex Resumption of Trading after the weekend

Resumption of Trading after the weekend Types of Gaps in Forex

Types of Gaps in Forex