Após a ascensão da tecnologia digital, a América Latina está se tornando um ponto quente para o uso de criptomoedas, apresentando uma mistura de oportunidades e obstáculos.

Países como Brasil, Argentina e México estão deixando sua marca no Índice Global de Adoção de Criptomoedas , mostrando um forte interesse em avançar para finanças descentralizadas. No entanto, a ameaça de uma inflação elevada é uma grande preocupação, levando muitos a utilizar ativos digitais.

Com o crescente interesse nas criptomoedas, muitas bolsas surgiram em toda a América Latina, cada uma esperando obter uma fatia deste mercado em crescimento. C-Patex está entre os líderes, graças aos seus recursos avançados e ambiente fácil de usar, que atendem aos diversos interesses comerciais da população local.

A criptomoeda na América Latina não se trata apenas de investimento e comércio, mas também de uma forma de incluir financeiramente mais pessoas, proporcionando novas formas de envolvimento económico numa região frequentemente atingida pela instabilidade financeira.

Encontrar a melhor exchange de criptomoedas da América Latina pode ser como passar por um labirinto de opções, cada uma com seu próprio conjunto de vantagens e desvantagens.

À medida que os entusiastas da criptografia exploram esta área, é muito útil ter um guia para encontrar as melhores exchanges.

Este artigo pretende ser esse guia, destacando as principais exchanges de criptomoedas da América Latina, explorando suas características, medidas de segurança e benefícios exclusivos em um mercado altamente competitivo.

Coisas a serem observadas ao escolher uma exchange de criptomoedas na América Latina

Começar com criptomoedas envolve escolher uma plataforma de câmbio confiável, uma decisão crucial para sua jornada de negociação ou investimento.

No crescente cenário criptográfico da América Latina, muitas exchanges estão tentando chamar sua atenção, cada uma apresentando um conjunto único de recursos.

O desafio é: como você classifica essa longa lista para encontrar aquela que corresponde ao seu estilo de negociação? Aqui estão alguns fatores importantes a serem considerados:

1. Localização

Antes de mergulhar, verifique se a bolsa funciona em seu país ou estado e segue as leis locais. Algumas bolsas possuem endereços de sites específicos para diferentes locais, mostrando onde operam.

2. Facilidade de uso

Você é um trader experiente ou novo em criptografia? A facilidade de uso que uma bolsa oferece pode afetar muito sua experiência de negociação. Escolha exchanges com interfaces simples, especialmente se você for novo no mundo das criptomoedas.

3. Liquidez

A liquidez é essencial para um bom ambiente de negociação. Certifique-se de que a bolsa tenha liquidez suficiente para permitir negociações tranquilas, reduzindo as variações de preços na execução de ordens.

4. Ativos disponíveis

Verifique se a bolsa possui os pares de negociação nos quais você está interessado. Embora as grandes criptomoedas geralmente sejam listadas, se você gosta de altcoins menos conhecidas, suas opções podem ser limitadas.

5. Segurança

O mundo digital tem seus riscos. Fortes medidas de segurança são cruciais para proteger seus ativos contra atividades maliciosas. Procure recursos como armazenamento refrigerado e carteiras com múltiplas assinaturas para segurança extra.

6. Reputação

Verifique avaliações e depoimentos para avaliar a reputação da bolsa. A melhor exchange de criptomoedas da América Latina provavelmente oferecerá uma melhor experiência de negociação e ganhará a confiança de seus usuários.

7. Taxas de negociação

Taxas ocultas podem reduzir seus lucros. Entenda a estrutura de taxas, incluindo taxas de negociação, depósito e retirada. Algumas bolsas oferecem descontos em taxas se você mantiver seus tokens nativos, o que pode ser uma vantagem.

8. Moedas Suportadas

Verifique a variedade de criptomoedas e moedas fiduciárias suportadas na plataforma. Uma gama mais ampla oferece mais opções de negociação e flexibilidade.

9. Suporte ao Cliente

O suporte rápido ao cliente pode ser muito útil. Certifique-se de que a melhor exchange de criptomoedas da América Latina tenha uma equipe de suporte ao cliente ágil para ajudar com suas dúvidas e problemas.

10. Acesso móvel

No mundo agitado de hoje, poder negociar em qualquer lugar é importante. Verifique se a bolsa possui um bom aplicativo móvel para negociação.

11. Recursos de aprendizagem

Para iniciantes em negociação de criptografia, os recursos educacionais são muito úteis. Procure plataformas que oferecem tutoriais, guias e outros materiais de aprendizagem para melhorar seu conhecimento comercial.

12. Integrações de terceiros

As integrações com aplicativos de terceiros, como aplicativos de gerenciamento de carteira ou portfólio, podem aprimorar sua experiência de negociação, oferecendo ferramentas e insights extras.

13. Desempenho anterior

Analise o desempenho anterior em relação ao tempo de atividade, incidentes de segurança e satisfação do cliente para avaliar a confiabilidade da exchange.

14. Conformidade Regulatória

Uma exchange que siga padrões regulatórios provavelmente será mais confiável e sustentável ao longo do tempo.

Principais exchanges de criptomoedas da América Latina

O cenário das criptomoedas na América Latina é tão variado quanto a região, hospedando inúmeras exchanges, cada uma com suas características distintas.

Uma avaliação cuidadosa baseada em múltiplos factores como segurança, liquidez, facilidade de utilização e muito mais traz à luz os líderes da região.

Aqui está uma olhada em algumas das principais bolsas de criptografia da América Latina que deixaram sua marca no mercado:

C-Patex

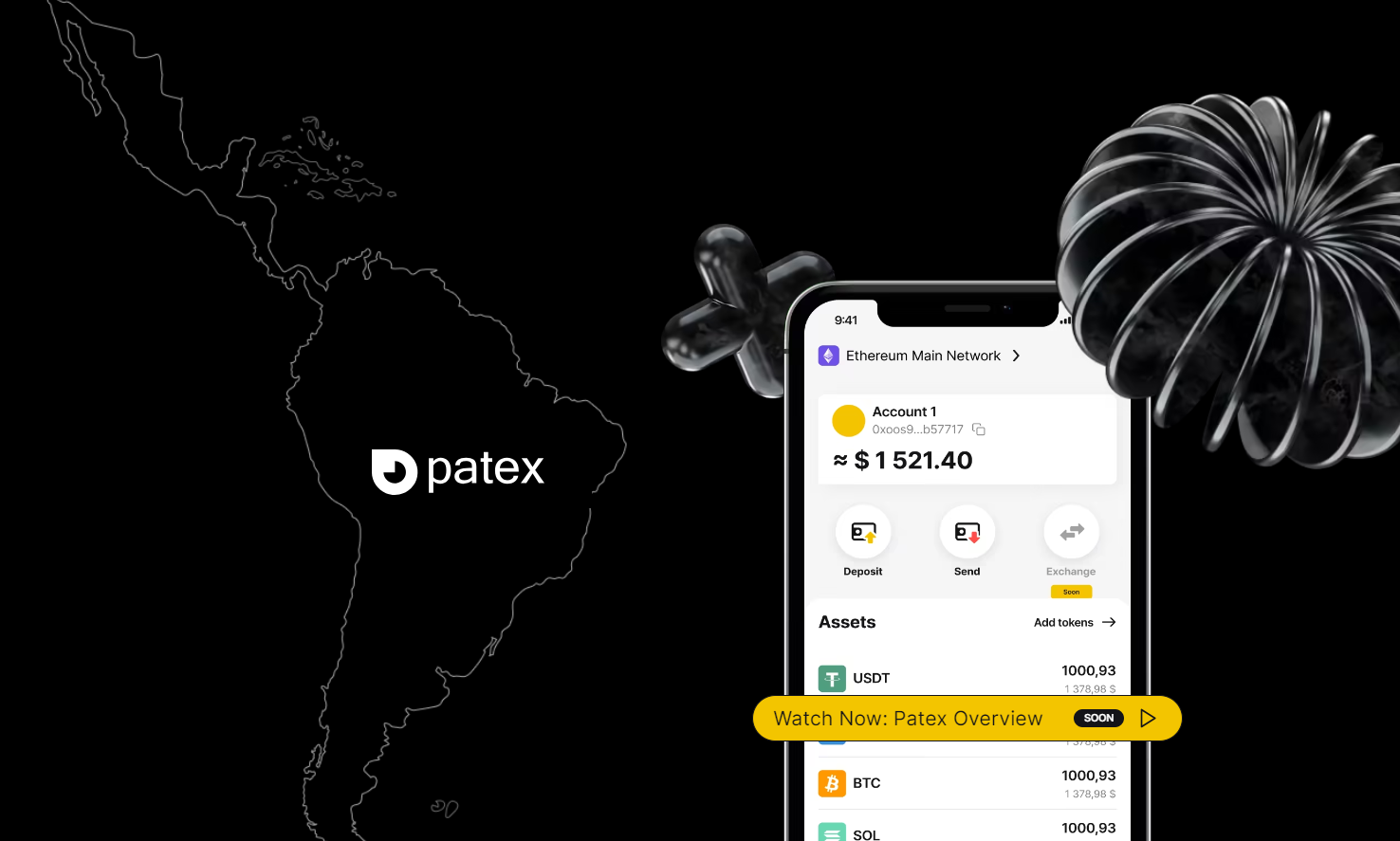

Com mais de 4 milhões de usuários e um volume de negociação notável, o Ecossistema Patex , por meio de sua plataforma C-Patex (provavelmente a melhor exchange de criptomoedas da América Latina) , se estabeleceu como um ecossistema centralizado e público focado na região LATAM para negociação, regulação, e emissão de tokens CBDC.

A bolsa possui alta liquidez, presença de tokens pouco conhecidos com potencial de crescimento significativo e suporte ao cliente 24 horas por dia, 7 dias por semana.

Bybit

Vista como uma das melhores bolsas em geral, a Bybit se tornou a favorita entre muitos traders na América Latina devido aos seus recursos avançados, reservas claras, interface fácil de usar e ampla gama de ofertas. A ampla disponibilidade da plataforma garante que um grande número de fãs de criptografia na região possam utilizar seus serviços sem problemas.

Binância

Binance é um nome bem conhecido no círculo criptográfico e por um bom motivo. O suporte multilíngue da plataforma atende a comunidade latino-americana com diversidade linguística, enquanto seus recursos de negociação avançados proporcionam uma experiência de negociação refinada para traders experientes.

KuCoin

Reconhecida por sua plataforma moderna, a KuCoin se destaca como uma das melhores plataformas de negociação de altcoins da América Latina. A plataforma oferece uma variedade de estilos de negociação atendendo tanto a traders novos quanto a experientes, garantindo uma experiência de negociação personalizada.

Bitso

Ao compreender as necessidades e desafios únicos dos comerciantes locais, a Bitso consolidou-se no cenário criptográfico da América Latina. A plataforma permite depósitos e saques diretos em moedas locais, posicionando-a como uma bolsa local de criptomoedas líder na região.

Conclusão

A história das exchanges de criptomoedas na América Latina é de resistência, criatividade e uma sólida dedicação à promoção da inclusão financeira. À medida que estas plataformas abordam o intricado panorama regulamentar e abordam os obstáculos únicos da região, são cruciais para alterar o cenário financeiro.

A mistura de exchanges estabelecidas e emergentes, cada uma com suas características únicas, apresenta um ecossistema criptográfico dinâmico e em mudança.

Estão a criar um espaço onde os indivíduos podem não só negociar ativos digitais, mas também obter uma melhor compreensão do mundo financeiro.

Além disso, as soluções inovadoras para lidar com preocupações de segurança, melhorar a experiência do usuário e oferecer uma ampla variedade de opções de negociação destacam a natureza dinâmica do cenário de exchanges de criptomoedas na América Latina.

A cada passo, dão o exemplo a outras regiões, mostrando como a combinação de sistemas financeiros tradicionais com plataformas de ativos digitais pode tornar o ecossistema financeiro mais inclusivo e acessível.

Embora o caminho a seguir tenha os seus desafios, é promissor. À medida que as estruturas regulatórias melhoram e os avanços tecnológicos continuam a entrar na criptoesfera, o papel das exchanges de criptomoedas na América Latina deverá se tornar ainda mais vital.

A combinação de mudanças regulatórias positivas, inovação tecnológica e aumento do conhecimento criptográfico entre as pessoas está desencadeando uma nova fase de capacitação financeira na região.

A história da criptografia na América Latina ainda está em desenvolvimento, com bolsas como a C-Patex no centro desta narrativa crescente. Os seus esforços contínuos para adaptar, inovar e interagir com a comunidade não só impulsionarão o crescimento do ecossistema criptográfico, mas também ajudarão numa mudança socioeconómica mais ampla na América Latina.

Read More:

tech trends with phaneesh murthy

earning a degree can be expensive but which example shows why it might be worth it?

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.