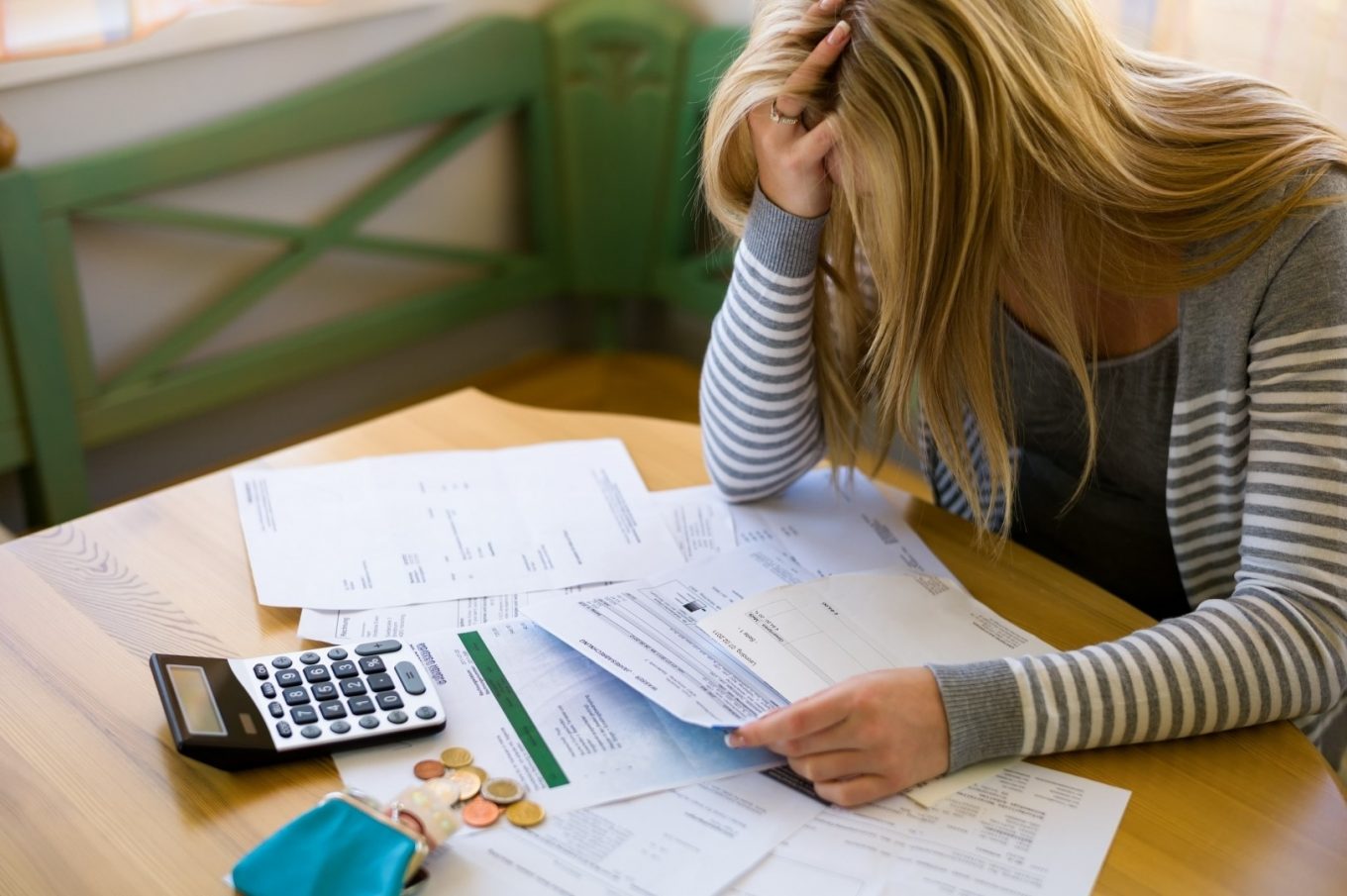

When you are young, you may have decided to apply for as many credit cards as possible. While this may have seemed like a good idea at the time, if you wound up using all these cards, you may now find yourself swimming in credit card debt.

When you are drowning in all the debt you have accumulated, you may feel like you have few options. There is good news, there are a few viable ways to eliminate your debt problem for good.

An option that has become popular in recent years is credit consolidation. With these services, you can receive professional help from debt and credit experts. With this help, you can get out of debt once and for all. However, before jumping in to this debt solution, you have to make sure you find the right company to help you along the way.

Why the Credit Consolidation Company Matters

You may think that all credit consolidation services are created equal. This is simply not the case. The fact is, these services are very different and as a result, you need to take the time and put in the effort to find a quality and reputable service provider. The good news is, there are a few guidelines that can help you make this important decision, which are found here.

Reputation of the Service Provider

One of the first things a person should look at when hiring a credit consolidation service is their reputation in the community. For example, are they well known and trustworthy? Do people turn to this service over others? It may even be beneficial to ask for some recommendations from other people who have used these types of services in the past. By doing this, you can get some insight regarding how the consolidation service works, the benefits of using it over another service provider and other information that may not be found online.

Cost of the Consolidation Services

It is important to keep in mind that the whole reason you need credit consolidation services is because you have too much debt. As a result, you don’t want to wind up using a service that charges crazy amounts of money. This will only make a bad situation worse and increase your financial burden.

It may be a good idea to compare the prices of several service providers before making a decision. When you do this, you will be able to see the average price range and if a provider is much higher or lower than everyone else, you can flag them. After all, there has to be a reason. If the price is much higher, it could be because they are offering more value or features with their services; however, it may also mean they are simply trying to rip off customers. If the cost is much lower, then the company may offer subpar services or not be legitimate. Be sure to find these things out before choosing a service provider.

When you are in a bad financial state, you may wonder what options you have to resolve these problems. The good news is, there are several ways that you can get out of debt, with one appealing option being credit consolidation. If you are interested in this service, make sure to keep the information here in mind to find a quality service provider. Find out more information about these services from a quality, proven service provider, Consolidated Credit. When you do this you will be able to have confidence in the services that you are receiving.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.