By including the unbanked, Humaniq improves banking for all

By Olivia Chow

Because Humaniq is focused on financial inclusion, its application is designed to make it easier for the unbanked, the undocumented and the undereducated to make global payments with less red tape. It incorporates blockchain technology and biometrics ID to further streamline and secure the process, improving the experience of those in a more privileged place as well.

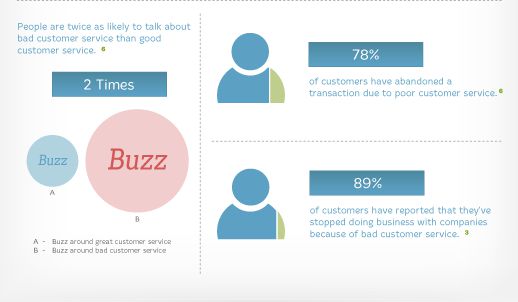

I spent the past three months sending cross-border payments, generating quotes and testing money transfer operators (MTOs) for the finder.com Money Transfer Awards 2017. (For you skeptics, in an effort to genuinely understand why 96% of Americans are unhappy with their service, we did not receive compensation from any of the providers.)

Why are people dissatisfied? One of the biggest suspects are the security complications involved with signing up and sending transfers. Interestingly, although Humaniq emphasizes the 2.5 billion unbanked who could benefit from its new type of banking, these innovations could improve the experience of all users.

While sending transfers, we found that security measures often unnecessarily extend the signup process and could even result in transfer failures after the provider had already withdrawn your funds. This meant having to wait for the funds to be returned often five to seven days later. When I called providers about my transfer failures, I was essentially told, “tough luck” — no explanations, no suggestions as to how to successfully complete a transfer. The only consolation offered was to initiate a transfer at a physical location, if available, where fraud liability is often on the consumer rather than the provider.

Furthermore, the failed transfers that resulted from undisclosed security reasons were all from providers that did not ask for additional documents or ID during the signup process. They appeared to have a less involved verification process, but this leniency may have resulted in consequences (and frustrations) later in the transfer. All of these issues, and we were making global payments as a homegrown citizen.

For the final round, a qualifying measure that we required of the providers was the ability for users to be approved entirely within its web application, without calling a representative or emailing additional documents. This requirement removed five providers that could have been finalists. Still, even when screened for this requirement, only 38% of our finalists did not require inputting a Social Security number to sign up or upload documents to their web application.

We understand keeping these “know your customer” processes in place are fundamental to anti-laundering efforts, but they can be stressful for those who just want to be sure their loved ones are taken care of — even when they have the proper documents. With Humaniq, users verify their identity by taking a series of photos, recording videos of facial gestures, and recording speech. No government documents required. Just your existence. In this regard, Humaniq’s success could mean a success for all.

Olivia Chow is the Consumer Trends Expert at personal finance comparison website finder.com. Passionate about understanding the consumer experience and how we can improve upon it, she was the project lead for the finder.com Money Transfer Awards 2017 and watches fintech to see how it will shape our everyday lives.

Olivia Chow is the Consumer Trends Expert at personal finance comparison website finder.com. Passionate about understanding the consumer experience and how we can improve upon it, she was the project lead for the finder.com Money Transfer Awards 2017 and watches fintech to see how it will shape our everyday lives.