Bitcoin was originally introduced in 2009 as open-source software, powered by an innovative technology called blockchain. It is, therefore, the oldest and most popular out of all the cryptocurrencies. Though many other cryptocurrencies have made their way to the market (a total of 5,000), Bitcoin continues to dominate the market share (46.55% in 2021).

Bitcoin was originally introduced in 2009 as open-source software, powered by an innovative technology called blockchain. It is, therefore, the oldest and most popular out of all the cryptocurrencies. Though many other cryptocurrencies have made their way to the market (a total of 5,000), Bitcoin continues to dominate the market share (46.55% in 2021).

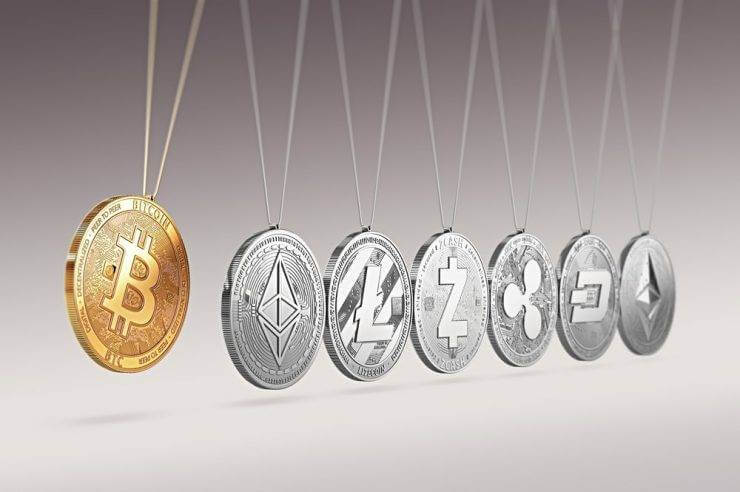

Bitcoin is believed to be in correlation with altcoins (other alternative cryptocurrencies), following its fundamental code, and even the market trends linearly. However, these seem to be mere speculations, with no establishments of any nature.

Bitcoin preference

Bitcoin preference

In its 10 years of existence, the blockchain has armored itself successfully from any hacking attempts. Bitcoin is, therefore, still considered to be the most secure crypto asset. Further, most of the altcoins do not pair with the fiat currencies, they can only be transacted using Bitcoins. Hence, the market turns green for buying the altcoins when Bitcoin shows stability in the markets.

As a general trend, investors start dumping altcoins for Bitcoin when it turns bullish. Therefore, a plummeting Bitcoin price would contribute to falling altcoin value, acting as an anchor for the markets. Most of these altcoins can be traded against crypto in so-called crypto exchanges like Binance, Coinbase or trading softwares like Bitcoin loophole.

Correlation between Bitcoin and altcoins: myth or reality?

According to market experts, Bitcoin has a dynamic effect on altcoin prices. In other words, the fluctuations in altcoin value could be correlated to Bitcoin value either directly or case specifically correlated to the altcoin

Presenting here some of the trends that happened over the year for a better understanding.

Starting below $30,000 at the beginning of the year, Bitcoin rose to an all-time high of $64,000 in May. However, it took a dip the following month to $30,000, rising again since July. Its current status is $47,000. Incidentally, altcoins like Ethereum, Dogecoin, and Cardano presented a parallel high between April and May.

Talking about Ethereum, markets reveal that it rose smoothly since January, reaching $4297.96 in mid-May, plummeting more than 50% by the end of June, regaining its market control to the current value of $3342.76.

Similar price trends were seen with Cardano, increasing through January to reach an all-time high of $2.4182 by May, crashing down by 50%, surging in value again to hit a new high of $2.944.

Dogecoin also remained high till May, reaching its new high of $0.7364, dipping in July, and regaining its current trade value to $0.3.

From the above-listed trends over the year, you can establish that there occurs a positive correlation between Bitcoin and major altcoin players, though the range is quite case-specific for most of them. While some altcoins present a strong correlation, others exhibit variations depending on Bitcoin value only to some extent.

To know more about the trends and getting to trading cryptocurrencies, read about the Bitcoin Loophole review.

Conclusion

You must be cautious of the fact that these relations are subject to many factors. However, one can never be certain to predict the trends but to closely monitor them, and make wise investment decisions. This is a continuous process and observing, analyzing, and decision-making. Making strategic adjustments according to the market trends is a better way to end up making profits from the crypto markets.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems

Bitcoin preference

Bitcoin preference