The blockchain industry and number of cryptocurrencies has grown exponentially since Bitcoin’s inception in 2009. Much of this growth was only recently realized in the past few years due to the influx of ICOs (Initial Coin Offerings). In 2017 alone, more than $4 billion was raised from hundreds of ICOs and 2018 is expected to be even bigger.

So, what exactly are ICOs? An ICO is a method of fundraising for a new project utilizing cryptocurrency or digital tokens in their underlying product or business. The ICO is commenced by these new projects by selling their cryptocurrency or token to investors who believe in the project or the investment opportunity it presents. It’s very similar to crowd funding or IPOs (Initial Public Offerings), in which investors who fund the project hope to receive a return on their investment. In the case of ICOs, investors are expecting the cryptocurrency or token they receive to go up in price as the project develops into a working product. While investing in an ICO can be very profitable, there is also a lot of risk involved, as with investing in all start up companies which is essentially what an ICO is. Therefore, it is vitally important to know how to choose a proper ICO and how to avoid scams and weak projects.

How to choose an ICO

There are numerous ICOs out there and all of them claim to be the next best thing and promise huge returns on investment, however, this is rarely the case. Last year in 2017 nearly half of all ICOs have already failed and many of the remaining ones are failures in the making. Therefore, it’s important to know what to look for when choosing an ICO. See below, the most important things to look for in an ICO.

The development Team

The development team is what brings the project to fruition and is vital to a projects success. You must make sure the developers are not anonymous and have somewhat of a reputation in their field. Be sure to research them on Google, social media, and view their LinkedIn profiles.

Media & Community

Make sure that the ICO has a wide following and open community. Check Reddit forums, Twitter, Facebook, Telegram and so on for information regarding the project and ICO.

Read the Whitepaper

You should always know and understand what you’re investing in, which is why you should read the whitepaper or at least a summary of it.

Stage of Project

An ICO can be commenced in any stage of the project. Some ICOs may only have a whitepaper, while others already have working products or are established companies to begin with. ICOs which are only backed by an idea are riskier investments.

Successful ICOs

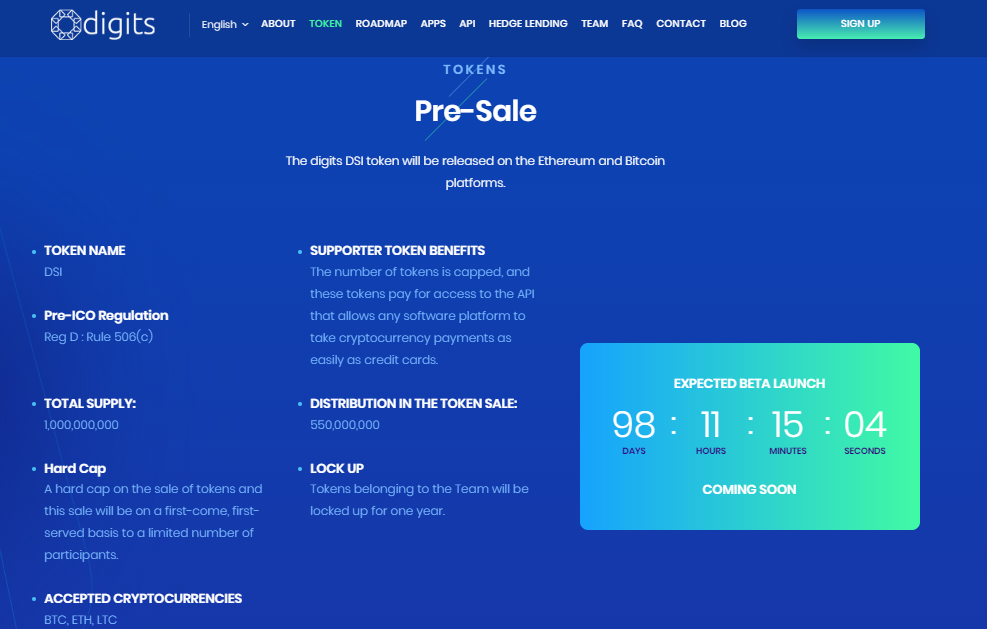

While successful ICOs are hard to come by, if one is found it can be highly profitable. One such company which meets the criteria of a potentially successful ICO is Digits. Digits is an innovative fintech company which is working to provide an easy crypto payment method which can be used anywhere, any time, any place. Digits enables users to transact crypto just like fiat using any debit or credit card.The Digits company is doing an ICO and it checks all the boxes and more. For instance, the Digits team is extensive and reputable with a full list of all team members complete with their personal Facebook, Twitter, and LinkedIn social media links. Also, Digits already has a working product which can be downloaded and used from the Apple App Store and Google Play store. More enticing aspects of the Digits ICO is their complete and comprehensive whitepaper and summary, roadmap with milestones and progress, and variety of media coverage and social media presence. The Digits ICO appears to be to one that will succeed.

Sponsored Content

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.