One of the most exciting innovations in 21st century finance history is the introduction of mobile money.

The 2016 World Bank’s Migration and Remittances Factbook indicates that close to 3.4% of the world’s population live outside their birth country. Based on World Bank data, the total of global remittance in 2015 amounted to $581.6 billion of which over 70% was sent to third world countries.

Mobile industry experts believe that the growth catalyst in the international remittance industry has been largely due to the introduction of mobile money. By leveraging on the high mobile penetration rate in developing economies and asset light business models, mobile money has helped to lower the cost of remittance significantly hence helping to capture more low value remittance transactions.

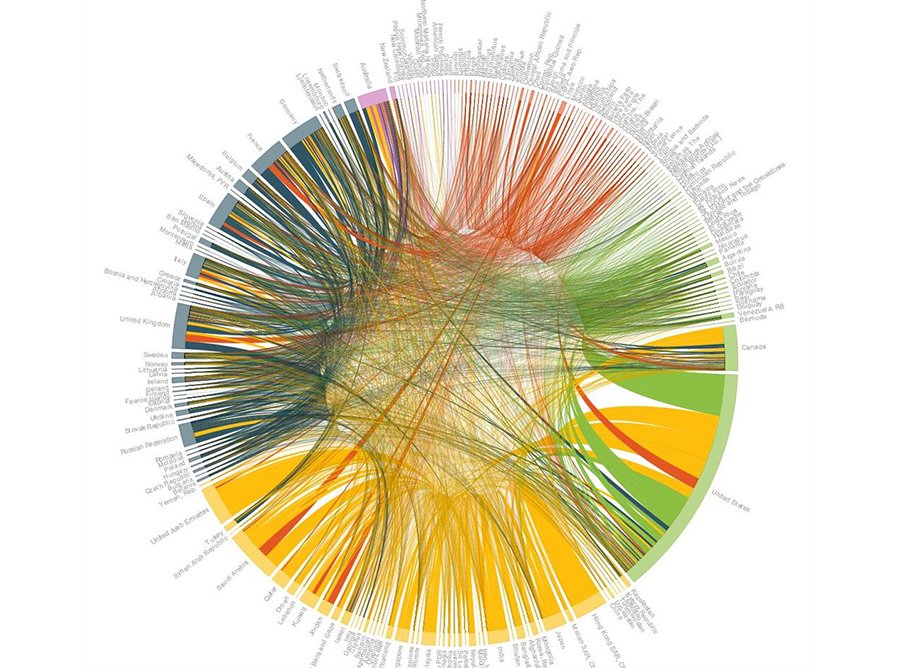

Migration and Remittances Factbook World Bank

Based on research conducted by the GSM Association (GSMA), there are currently 53 mobile money services servicing more than 170 million money accounts. These accounts allow the account holders to send money to 45 countries worldwide.

Most of these country corridors are located on the African continent and interestingly enough, in regions which are also serviced by the traditional remittance channels. However because of the limited geographical presence of the traditional remittance channels, the services provided Money Transfer Operators (MTOs) are much more expensive than remittance done through mobile money.

On the whole, mobile money represents a much cheaper alternative for migrant workers to remit money back to their home countries.

For a migrant worker from countries such as Côte d’Ivoire, Mali or Senegal, he can conveniently use Orange Money to send back money which he earned in France. In 2015 alone, over $5 billion was remitted using mobile money.

While this amount represents only small portion of the total amount of money remitted to the third world countries, mobile money actually shows a lot of potential in revolutionizing the international remittance industry.

Orange money Office in France

For mobile operators widening their revenue streams through mobile money, their investments into mobile money will definitely have a positive impact on the financial ecosystem in terms of sustainability and profitability.

Operators who enter into strategic partnership with different parties across the remittance chain will in turn will open up more opportunities for new players to partake in the remittance industry.

For consumers, the use of mobile money for remittance offers several advantages such as increased security and convenience. Individuals and families will be able to receive remittances directly to their mobile phone eliminating the need to go to a remittance center to cash out.

In addition, the remittances received in the digital wallet can also be used to make payments or simply stored as savings. On the sender side, the sender will be able to initiate the fund transfer directly from the mobile without the service of a remittance agent hence cutting down the time needed to make a remittance.

GSMA studies have shown that the average cost of remitting $200 is merely 2.7% through the mobile money network as opposed to 6% charged by traditional Money Transfer Operators (MTOs).

In other words, remittance cost is 50% lower than traditional means of money transfer. The significantly lower cost of remittance is the key reason why we have seen an uptick in small value transactions in recent years.

According to the 2015 Global Adoption Survey of Mobile Financial Services, the average value of transactions conducted through mobile money is merely $82 as opposed to $500 for transactions conducted through all channels of international remittance. The implication of this is that mobile money not only expands financial inclusion but also increases disposable income for people who needed it most.

Sustainable Development Goals

It should be noted that mobile money is not merely about reducing the cost of remittance. In fact, it also represents a tool which can be used to bring financial inclusion to the unbanked and help to bring the flow of funds from the informal economy to the formal financial ecosystem.

In other words, the unbanked now through mobile money have a gateway which they can tap into to access more financial products and services that can meet their various financial needs bringing the developing economies one step closer to the 2030 targets established by the Sustainable Development Goals 10 (SDG 10.c).

Article powered by Humaniq

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems.