The financial crisis in the United States was the worst since the Great Depression. The recession, which began in the United States because of a housing market crash, threatened to destabilize the entire global financial system. The Great Recession resulted in a loss of more than a trillion dollars in global economic growth and the failure of Lehman Brothers, one of the world’s largest banks. Finally, the Great Recession showed the banks’ inability to have a clear view of the risks quickly and productively in an enterprise and handle these risks in a timely manner due to a lack of compliance in both the housing and banking industries.

As a result, in January 2013, the Basel Committee on Banking Supervision announced BCBS-239. Banks were punished by BCBS-239 for not doing enough to reduce risk and comply with regulations. Due to an outdated data infrastructure within their organization, banks are currently struggling to comply with BCBS-239. According to a Mckinsey, the number one obstacle banks face while attempting to comply with certain requirements is getting an inefficient data model. In other words, since data is stored in various data warehouses without a standard data model, banks’ greatest challenge is extracting meaningful information from complex data structures.

BCBS-239 establishes a new reporting period in which quarterly overall risk reports are required. Instead of manual data deliveries, these risk reports must be generated using an automated reporting system. To put it another way, excel spreadsheets are no longer acceptable as documentation. As a result, automating data lineage tool is critical for financial institutions; it must be a top great move for all banks.

The ability of economies that haven’t grown as rapidly to raise their production levels to about 4% to 4.5 percent per year can also be estimated using true data and accurate data structures. If this occurs, emerging economies could add $11 trillion to global GDP by 2030, the equivalent of adding a new economy the size of China to the global economy.

Fortunately, through contextualizing their data with Data Lineage, financial companies may more effectively comply with regulations. By monitoring how data flows across systems from source to destination or study, Data Lineage aids BCBS-239, GDPR, CCPA, and other enforcement efforts. Banks are expected to report thousands of statistics to regulators under BCBS-239, and many of these statistics must be produced by combining data and information from various systems. Data Lineage assists banks in meeting these demands by connecting different systems and processes and providing a full image of how data is going through the organization from the practical, mental, and physical levels Data Lineage also allows banks to export data lineage diagrams in a variety of file formats, including PDF, PNG, and CSV, for easy reporting to supervisors.

Technical domain

To create a risk report, banks must uncover the data that is upstream to the point of origin. The data origin processes and fields must be traced back in a competent study. It’s also important to see the IT and business controls at each point to ensure that the data hasn’t been tampered with. Regulators want banks to demonstrate that they have control over their data with BCBS-239. They want to ensure that banks have confidence in their reports and that any potential risk areas have been identified.

Although achieving BCBS-239 enforcement can seem straightforward, it is a complex and time-consuming process. At large banks, collecting this data from diverse departments and divisions can take millions of people. Banks must also report annually under BCBS-239.

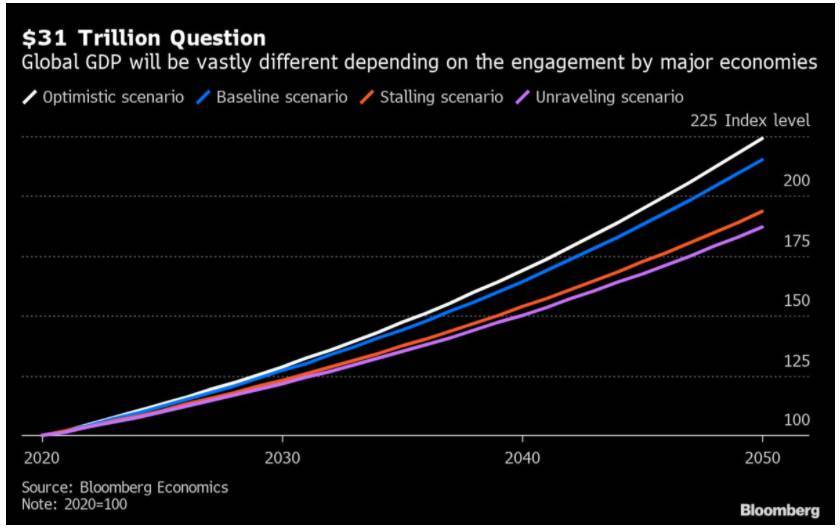

Bloomberg Economics calculated that in a scenario where relations splinter back to the stage before China joined the World Trade Organization in 2001, global gross domestic product would be $31 trillion lower by 2050 than in a scenario where the US and other major economies commit to globalization implementing data linage. This is the same as giving up the United States, Japan, and Germany’s entire annual output.

Bloomberg Economics calculated that in a scenario where relations splinter back to the stage before China joined the World Trade Organization in 2001, global gross domestic product would be $31 trillion lower by 2050 than in a scenario where the US and other major economies commit to globalization implementing data linage. This is the same as giving up the United States, Japan, and Germany’s entire annual output.

Does automated data lineage help banks comply with BCBS-239?

First and foremost, while BCBS-239 can seem overwhelming, Data Lineage makes it easier by automatically creating lineage from a variety of sources and keeping it up to date. This automated feature saves IT 95% of the time it takes to manually chart lineage. Furthermore, since BCBS-239 is an annual law, providing up-to-date and reliable data is important for producing a high-quality report. BCBS-239 also necessitates electronic reporting Excel spreadsheets are no longer appropriate to regulators. As a result of automated data lineage, banks will comply with BCBS-239 guidelines while also freeing up IT resources to concentrate on strategic objectives.

Second, Data Lineage displays comprehensive technical and indirect lineage, allowing you to better understand and trust your data. You can see transformations, drill down into table, column, and query-level lineage, and explore your data pipelines using our comprehensive technical lineage view. You may provide regulators with all required details for BCBS-239 enforcement using the technical and indirect lineage views. You will see danger points in your company using a mix of technological and indirect lineage. Indirect lineage, for example, helps you to see where your data came from and trust that it is correct and reliable.

It displays the participating abstract relationships, such as conditional statements and joins that influence data transfer. The most critical mandate of BCBS-239 is to recognize these risk points because it allows your company to make the required changes to prevent inaccurate data.

Business Value enhanced

Single financial organization’s regulatory enforcement should be a primary concern. To comply with BCBS-239, banks must invest in an automated data lineage solution. Data lineage, on the other hand, is more than just a regulatory enforcement solution. You can scale the investment with Data Lineage to assist in all business units (business, IT, compliance, and marketing). Indeed, automating data lineage will assist you in unlocking the value of your data for business strategies.

IT and business users will collaborate on becoming a data-driven organization with Data Lineage. They’re both trying to figure out how to learn more about their data environment in a simple and efficient way. They need more detail about their results, as well as additional meaning, to be able to use it for their intended purposes. Data Lineage provides this knowledge through our commercial and technology lineage views, making it a multifunctional and realistic solution. Finally, Data’s automated data lineage makes it easier for businesses to comply with regulations, enabling them to concentrate on innovation and development. As a result, Data Lineage is a strategic activity for compliance with regulations as well as business initiatives.

Oxford Economics team of 250 economists updates its baseline global economic outlook using the Global Economic Model, the only fully integrated economic forecasting framework of its kind.

Although we have upgraded our global GDP growth forecast for 2021 again, to 6.0% from 5.6%, we do not expect this to trigger a sustained rise in inflationary pressures. We still view the pandemic as being disinflationary and expect the low inflation/low yield environment of the past decade to persist. The US looks set for an even bigger fiscal boost than we had expected a month ago, and its GDP growth is now seen at 7.0% this year.

Conclusion

While the COVID-19 pandemic in 2020 seemed to be a once-in-a-lifetime possibility, 2021 will bring its own set of challenges. Forward-thinking boards can help their bank succeed by taking a constructive and thoughtful approach to identifying, managing, and appropriately mitigating these key risks. To stay resilient in today’s environment, boards should enable management to have a regularly updated view of potential scenarios (ranging from the most probable to the most uncertain but possible), how they might affect the bank, and how the institution would react.

Founder Dinis Guarda

IntelligentHQ Your New Business Network.

IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies.

We exist at the point of intersection between technology, social media, finance and innovation.

IntelligentHQ leverages innovation and scale of social digital technology, analytics, news, and distribution to create an unparalleled, full digital medium and social business networks spectrum.

IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems