Funding is critical for business. Any company whether a Startup, SME or big corporation needs funding for building its business and deliver the best products, services or other core KPIs they aim to. Nowadays the way you fund a company or project is what differentiates it. And a great way to have a proper funding is to pitch a business idea to a business angel or VC.

As an entrepreneur, pitching the right business angel or VC, if you are most advanced and bold, is not an easy task so do your home work. Firstly you have to start understanding how the bets are mostly stacked against you in the beginning of the process of funding. Also bear in mind that most businesses with or without funding will fail after the first few years. Just look at the stats. But don’t panic as the reward is fantastic if you reach the end journey as entrepreneurs are the most satisfied people on earth according to almost all studies. So the more you do your homework the better your chances.

Therefore focus in creating a good business model and manage a healthy funding process. This is critical. The challenge then for an entrepreneur is to define 100% his or her place in any given industry, what it wants to achieve and work hard to make it happen and become profitable in the process. Moreover understand the right model to get funded and who to pitch correctly.

So if you want to start a business and change the vertical where your business is positioned and the products or services it is trying to provide understand the right path and manage all expectations. Getting off on the right foot is essential to navigating a startup, SME or other project from its infancy to growth and profitability.

The reality is difficult but thankfully there are countless startups, companies and their respective founders / entrepreneurs who have gone through the same path of trying to build their own businesses and getting the right funding that are happy to share their experiences – both their success and failures. You should learn with them. Also very important there are a large number of digital and social media projects, organisations and excellent platforms that can help you moving in the right direction to pitch your idea to get funding or understand what are the right steps or process, wherever you are to get what you want.

In addition as the internet and the app ecosystem becomes more sophisticated, there are now powerful platforms and hubs where using social media and web apps any business person entrepreneur can access to right people, Business Angel, VC and therefore reach their funding goals. Also websites and communities to VC and business angels you can subscribe or engage. Together, these resources can give you – the founder or team member of a new company the right edge and make you succeed in the process of pitching your idea in a fast-changing business world close to the right Business Angel or VC to get funding.

- startupweekend.org/resources/

- The Entrepreneur.com Startup Kits;

- eHow’s Introduction to Entrepreneurship;

- About.com Starting a Business Hub;

- Library of Congress’s Entrepreneur’s Reference Guide;

- Vator.tv;

- Alltop Startups;

- Introduction to Venture Capital;

- TheFunded;

- How to Fund a Startup;

- StartupNation;

- Hacker News;

- Young Entrepreneur;

- PartnerUp;

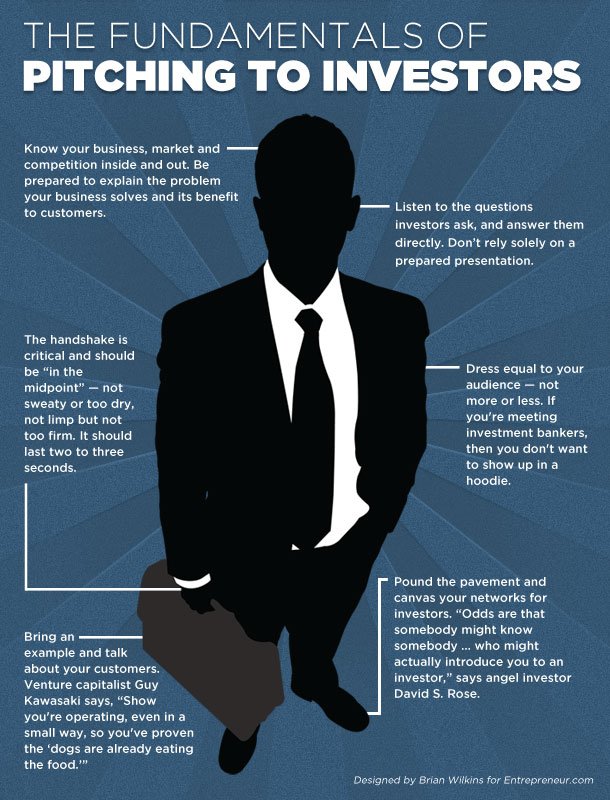

1. Approach an investor with a clear Summary Pitch about your business

“this project is a big data platform targeting a new generation of social SMEs or self directed professionals”.

Remember to include your contact information – name, email, phone. Especially if your deck was forwarded, it should be easy for a person to track you down.

2. Team

A good team is the DNA of any project. So work hard on it. Highlight all key members of the team, their profiles and achievements. Also highlight any good fathers or endorsements and investors that you had so far or your board members. Make sure to include your background, achievements and how it relates to your company. Highlight any of your team’s successful projects, exits. Investors like to see that you can take a company to the point of acquisition.

If applicable, emphasize that the project team has worked together in the past or for a long period of time. It shows you can and like to work together. If you have any important advisors, list them, but make sure they know you’re using their name.

3. Problem

What is the problem you want to solve with your business? What is the value you want to create? You need to be able to explain the problem the project concept is going to solve. Further, you need to prove why investors should care about solving it with your product or service.

4. Solution – Product value proposition

It is all about finding solutions in business. So map the value proposition the project is bringing to the table. It should solve the problem you just mentioned. If do this is half way. Moreover if you have a demo of your product, this is the time to show it. Also it should include the technology IP, the most valuable asset in my opinion.. Put a value on this and why is so unique.

Include any case studies to show that your experience or the product has worked for previews audiences existing customers. And show a clear demo in English or any other language for a market you are targeting.

5. Brand / Marketing / Sales

Without a brand you don’t exist. So make sure you draw you concept. Your value proposition. Work to show the market size for the project market, and of course the sales opportunity. This can include a clear portfolio fo what the brand represents. The contract the brand does with its customers, using Richard Branson words. Also nail the profiles of target customers, but be prepared to answer questions about the cost of acquiring these customers. Not knowing this information is a red flag for investors. If you already have sales, you can discuss your growth and forecast future revenue.

6. Projections or Milestones

Analytics and do teh right calculations are key for building a business and special to get funding. Start with the financial history, that work on the project forecast. Present the milestones that your network and contacts, the project envisions or already reached. For instance if your project is a website, include that you reached a given audience of 10k or 100k people, unique visitors or acquired 1,000 customers from X date, that you have a partnership with company Y or Z, that you signed a major customer or that you will be cash flow positive by Q3. Therefore it will be easy to calculate projections that you have a share of the one given market or excellent knowledge how to reach that market…

7. Competition

Mapping your competitors is key. The better you know about them the better you will be able to success and find the right business angle for your model and the necessary funding to compete with them or do better. So make sure you list your competition and why your product/service is different from their model. If your competitors have been acquired, list acquisition prices and who acquired them.

8. Business Model

There are plenty of ways to display your business model. Ultimately is has to do with yous vertical and industry area. Therefore you need to explain clearly what is the business model and how the project plan is going to generate revenue. A business angel or a VC don’t operate in the same way so do the home work and work with professionals or consultant professionals to help you. Show a list of the various revenue streams for the project model and the timeline for each of them. How will you price your product / services and what does your competition charge / does? You should also discuss the lifetime value of your customer and how you will keep him engaged.

9. Financing – Ask for money

The Holy Graal, the ultimate goal. Be prepared and remember everything has a price. But in the end someone has to pay the price. So be transparent about the past, present and future of your own personal finances, the partners, all the financial engineering about the project. Pay special attention to the present and vision with focus on what is the plan. Talk about the history so far. Who are the founders, their expertise, Investors, stakeholder partners. Talk about what you have accomplished with minimal funding. If you have personally funded your startup, make it known. Investors like to see entrepreneurs who have invested their own money.

List how much you’re looking to raise and how you intend to use the funds. And of course be very clear about what you want to offer in exchange. Be prepared to answer about what percentage you want to offer of your company or how many shares, options or other package you are looking to offer in exchange.

Bonus point – Preparing the Presentation

Have a clear strategy that disclaims and projects what is the offering proposal for an exit for the investors. Make sure that is clear and be prepared to answer to any related questions and bring your numbers, all not just the good ones, the bad ones as well. This is core and helps to show how good you are. Also make sure you list any similar companies, including similar products. And if there was similar projects that were acquired, or funded highlight why you think you can succeed as well in that industry or sector.

Some extra words. Remember the small things and study particular the wisdom of successful entrepreneurs and founders. Special the ones in similar areas of business or in the same industry. Please write on your note book:

fundraising is about knowing what you want and managing the right psychology and instinct, not just about rational business school fundamentals.

There are various and different principles, not everything works the same and each country and sometimes city has different approaches. But by knowing what you want to achieve and writing it down in a simple way, getting the right tagline you will be prepared and your chances of getting what you want are much better.

To finish understand these 3 fundamental aspects to get successful fundraising and in almost anything in life:

- Work hard! there are no easy rides in business in order to reach the momentum going and getting it you will have to go the extra mile a.

- Loose the fear of failing and do. Failure is part of the process so be prepared for ups and downs and move always forward learning with it. Each failure is a new way to learn as Edison put it.

- Fight Inertia – get out of procrastination, keep learning and improving. And go ahead and do it. It is not an easy ride but the end goal will be fantastic!

image credit via entrepreneur

Dinis Guarda is an author, academic, influencer, serial entrepreneur, and leader in 4IR, AI, Fintech, digital transformation, and Blockchain. Dinis has created various companies such as Ztudium tech platform; founder of global digital platform directory openbusinesscouncil.org; digital transformation platform to empower, guide and index cities citiesabc.com and fashion technology platform fashionabc.org. He is also the publisher of intelligenthq.com, hedgethink.com and tradersdna.com. He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays, and governments all over the world.

With over two decades of experience in international business, C-level positions, and digital transformation, Dinis has worked with new tech, cryptocurrencies, driven ICOs, regulation, compliance, and legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

He creates and helps build ventures focused on global growth, 360 digital strategies, sustainable innovation, Blockchain, Fintech, AI and new emerging business models such as ICOs / tokenomics.

Dinis is the founder/CEO of ztudium that manages blocksdna / lifesdna. These products and platforms offer multiple AI P2P, fintech, blockchain, search engine and PaaS solutions in consumer wellness healthcare and life style with a global team of experts and universities.

He is the founder of coinsdna a new swiss regulated, Swiss based, institutional grade token and cryptocurrencies blockchain exchange. He is founder of DragonBloc a blockchain, AI, Fintech fund and co-founder of Freedomee project.

Dinis is the author of various books. He has published different books such “4IR AI Blockchain Fintech IoT Reinventing a Nation”, “How Businesses and Governments can Prosper with Fintech, Blockchain and AI?”, also the bigger case study and book (400 pages) “Blockchain, AI and Crypto Economics – The Next Tsunami?” last the “Tokenomics and ICOs – How to be good at the new digital world of finance / Crypto” was launched in 2018.

Some of the companies Dinis created or has been involved have reached over 1 USD billions in valuation. Dinis has advised and was responsible for some top financial organisations, 100 cryptocurrencies worldwide and Fortune 500 companies.

Dinis is involved as a strategist, board member and advisor with the payments, lifestyle, blockchain reward community app Glance technologies, for whom he built the blockchain messaging / payment / loyalty software Blockimpact, the seminal Hyperloop Transportations project, Kora, and blockchain cybersecurity Privus.

He is listed in various global fintech, blockchain, AI, social media industry top lists as an influencer in position top 10/20 within 100 rankings: such as Top People In Blockchain | Cointelegraph https://top.cointelegraph.com/ and https://cryptoweekly.co/100/ .

Between 2014 and 2015 he was involved in creating a fabbanking.com a digital bank between Asia and Africa as Chief Commercial Officer and Marketing Officer responsible for all legal, tech and business development. Between 2009 and 2010 he was the founder of one of the world first fintech, social trading platforms tradingfloor.com for Saxo Bank.

He is a shareholder of the fintech social money transfer app Moneymailme and math edutech gamification children’s app Gozoa.

He has been a lecturer at Copenhagen Business School, Groupe INSEEC/Monaco University and other leading world universities.